Market Recap May 27, 2016

Another solid day for the bulls as we had yet another pop at the open and then another round of buying into the close. The S&P 500 gained 0.43% and the NASDAQ 0.65%. This despite some mildly (not overly) hawkish comments from Janet Yellen. “It’s appropriate for the Fed to gradually and cautiously increase our overnight interest rate over time,” Yellen said at a high-profile visit to Harvard University on Friday. That means a move could be appropriate in coming months, she said.

U.S. first-quarter economic growth was revised up to 0.8% from a previous reading of 0.5%, based on a fresh estimate that shows somewhat stronger home construction and restocking of warehouse shelves.

“I think if you look at the equity market and you look at Treasurys I think investors have upgraded their view of the economy a little bit. … You haven’t really seen that get translated into the Fed raising rates,” said John Bredemus, vice president at Allianz Investment Management. He noted while expectations for a rate rise have risen, the Fed is likely “not going to do much.”

“Yellen basically cemented what other Fed speakers had been saying over the past week and I am a little surprised how well the market has absorbed the news,” said Michael Antonelli, equity sales trader at Robert W. Baird & Co.

It is now a fair time to get out of the bunkers – the S&P 500 and Russell 2000 cleared resistance earlier this week, and Friday the NASDAQ joined the party.

The NYSE McClellan Oscillator has now been positive 3 sessions in a row.

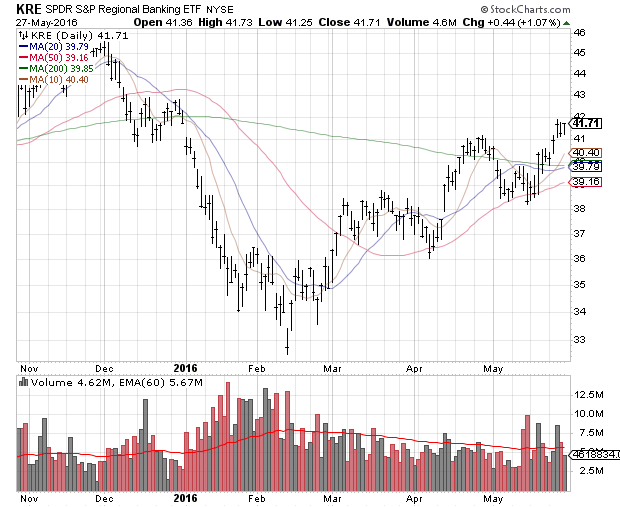

Financials had a strong week.

Good news in brick & mortar retail? Miracles do happen. Ulta Salon Cosmetics & Fragrance (ULTA) jumped 9.1% after earnings from the makeup retailer released late Thursday topped Wall Street estimates. This chart was actually very nice for a retail stock even before the earnings announcement.

The “low end” of retail continues to do well – as we saw earlier in the week. Big Lots (BIG) rallied 14% after the discount retailer boosted its outlook for the year and reported a 20% rise in profit.

Still the sector was not perfect – GameStop (GME) slumped 3.9% after the videogame retailer late Thursday reported an 11% drop in earnings.

Originally published by Mark Hanna at StockTrader.com.