How to measure inflation: CPI vs. PPI

According to Wikipedia, inflation is defined as the increase in general price levels of goods and services. However, accurately measuring inflation is challenging due to the wide variety of goods and services individuals purchase. Each person’s experience of inflation can differ, making it complex to determine how to measure inflation precisely.

Consumer Price Index (CPI): a common measure of inflation

In the US, the Consumer Price Index (CPI) is what most people use to measure inflation. The main reason is that many transfer payments, like Social Security, are based on that index. Since changes in the index directly impact many individuals, any changes in the composition and weights of the index are highly politically sensitive and may take a long time to implement. While, in general, it is a good measure of inflation, many market participants think it is not the best.

Did you know that CPI includes over 50,000 items?

Another commonly used measure of inflation is the Producer Price Index (PPI). As the name suggests, the Producer Price Index measures the average prices domestic producers receive for their goods and services. Many people incorrectly assume that PPI is only goods, but that is not true – it also has a service component. An advantageous aspect of PPI is that the changes in its level serve purely informative purposes – no individual receives disparate compensation based on the index level. Moreover, it has only 1000 items. If there is a need for altering the index composition or component weights, implementing those changes in PPI would be relatively straightforward, unlike in the case of CPI.

Understanding the relationship between CPI and PPI

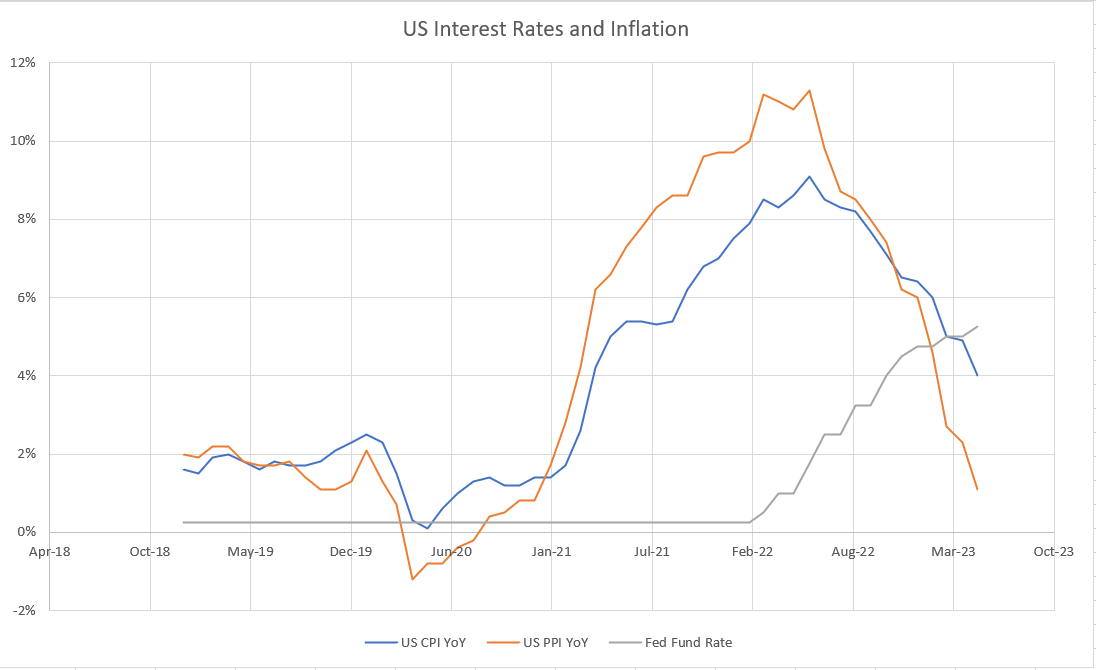

Let’s plot the changes in CPI and PPI along with the Fed Fund Rate. Observers can see a strong correlation between these two indexes. The correlation exceeds 80% in the long run.

It does seem that over the last five years, PPI has been more volatile and, in general, moving ahead of CPI (CPI tends to follow PPI). That has been true overall, even in the long run. It does make sense that producers adjust their prices faster and more often than most retail stores.

Recent Trends in CPI and PPI Changes

As of May 2023, annualized changes in CPI and PPI are 4.00% and 1.10%, respectively. Moreover, both are down significantly from their highs of 9.10% and 11.30% recorded in June 2022. It should also be noted that the present difference in the changes of CPI and PPI is unusually large. Most of the time, those indexes record very similar annual changes. This poses a dilemma; if inflation is at 4.00%, the Fed could be suitable to be concerned, but if inflation is 1.10%, it would be unwise to raise rates.

The role of housing component in CPI

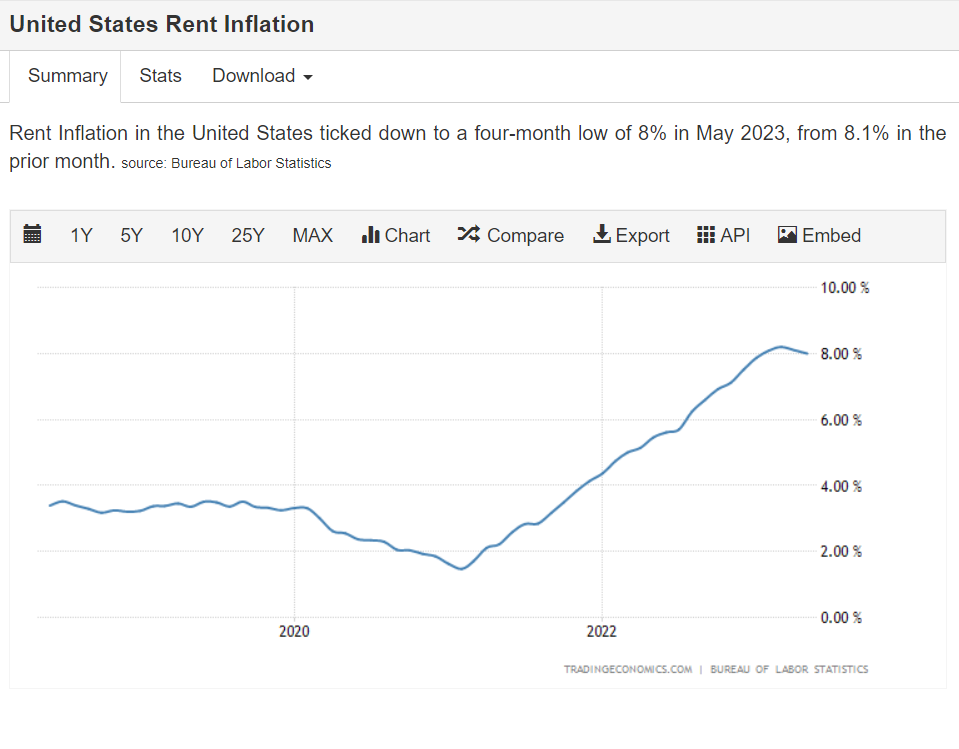

The main difference between the two indexes is attributed to the housing component of CPI. It carries a weightage of 40%. Please see below:

The critical thing about rent inflation is that it is not something the majority of consumers face – the homeownership rate is at 65% in the US. Those that do usually face rent inflation every 12-24 months. Furthermore, when calculating rent inflation, it considers solely the asking rent price. In soft real estate markets, it is a common practice to structure rental leases with “free month(s)” at the end of the lease. So, the asking prices could be high, but the “effective” rental cost would usually be 8-16% lower. Those incentives are NOT calculated in the rent inflation, and thus, rent inflation could be overreported.

In conclusion, there is no perfect measure of inflation. Inflation has been and most likely will continue to be an issue on which even intelligent people would agree to disagree. However, what is undoubtedly true is that for the first time in at least a decade, the Fed Fund rates are above the current CPI and PPI annual changes. We deem any other interest rate raises to be unnecessary.

Sources: