Projected Inflation 2023: Assessing the FED’s Performance

Grading the Federal Reserve on Stability, Employment, and Interest Rates

In the economic landscape 2023, we’re scrutinizing the Federal Reserve’s approach, under Chair Jerome Powell, to its three pivotal goals: ensuring “price stability,” maintaining ample employment opportunities, and averting tumultuous fluctuations in long-term interest rates.

This review includes a breakdown of the Fed’s performance on each goal, exploring the connection between projected inflation in 2023, employment, and interest rate dynamics. From navigating high prices to excelling in employment and addressing challenges with interest rates, let’s explore how the Fed manages these complexities in simpler terms.

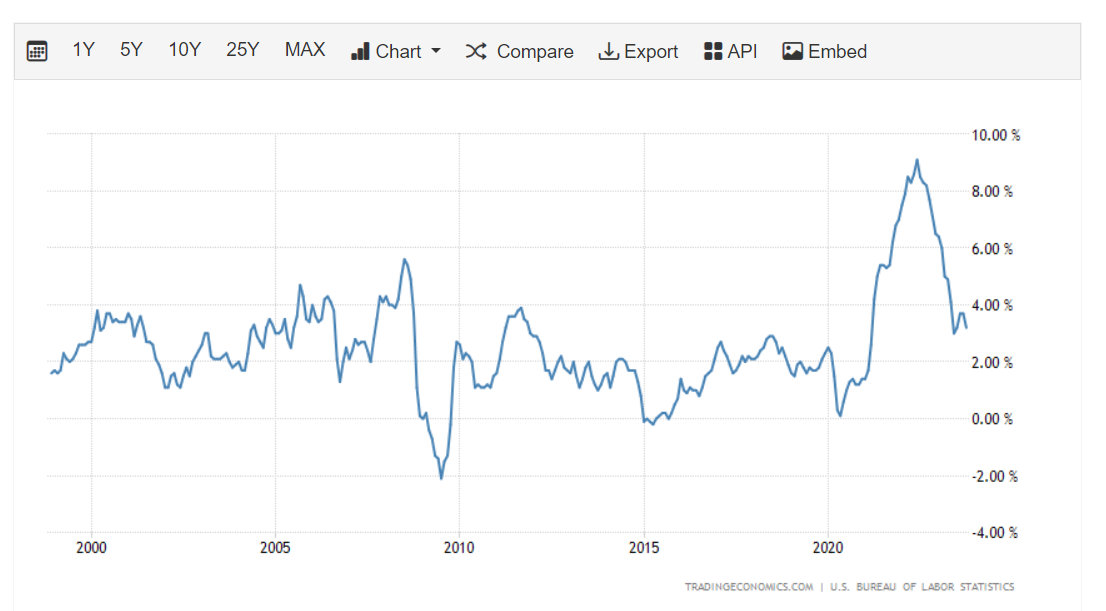

Pivotal Goal 1: Inflation

Let’s focus on the first dimension: inflation or the quest for price stability.

It would be hard to argue that the Federal Reserve has done an excellent job on inflation. Inflation has been quite elevated for three years now, 2021, 2022, and 2023. There have indeed been outside events like the COVID-19 epidemic and the Ukraine war that have contributed to price instability, so it is difficult to argue the Fed is 100% responsible for the inflation we see in 2023.

Still, the fact is that in the last three years, but especially in 2022, we have seen considerable price instability in the US (and most other countries as well).

Grade: Unsatisfactory

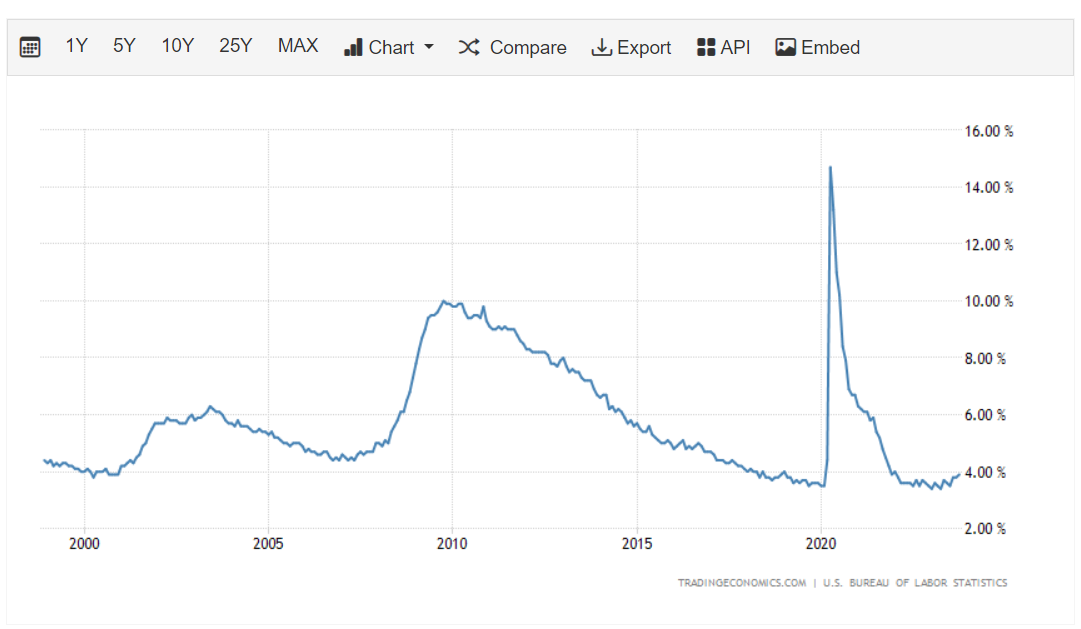

Pivotal Goal 2: Employment

Now, let’s talk about the second aspect of how the Federal Reserve is doing in 2023—jobs. We’ll look at how Chair Jerome Powell and the Fed are working to ensure enough jobs for people.

We’ll see how well their plans work, especially considering challenges like COVID-19. So, how’s the job scene shaping up? Let’s find out.

Similar to inflation, outside events, like the COVID-19 epidemic, played a significant role in the level of the US unemployment rate. However, it is easy to see that the current level of 3,9% is probably near the maximum employment level that is one of the Fed’s mandates.

Grade: Pass. Good job!

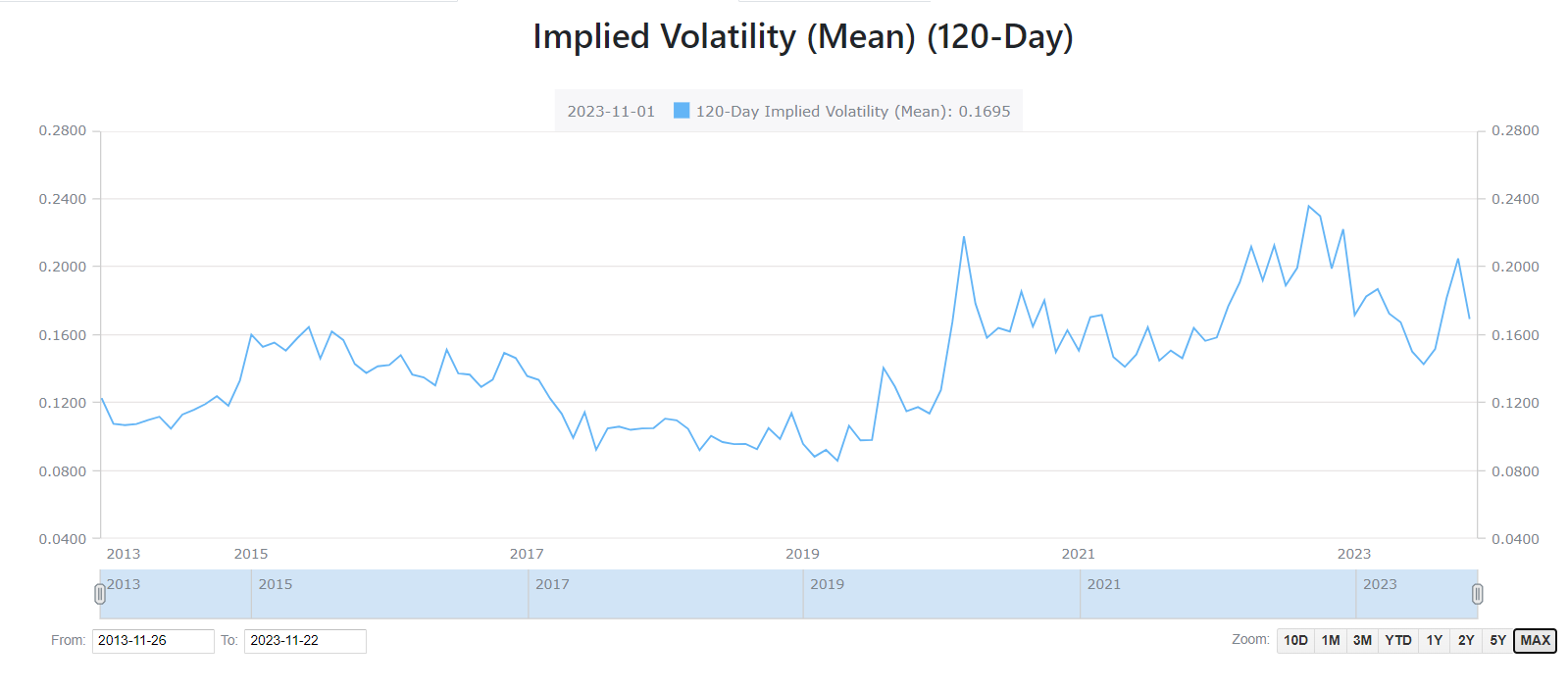

Pivotal Goal 3: Interest rates

Final mandate – moderating volatility of long-term interest rates:

We have plotted above the annualized implied volatility of TLT (iShares 20+ year Treasury Bond ETF). Again, events like COVID-19 in 2020 did play a role in the spike of volatility in Treasuries, but the big spike in 2022 and, to an extent, in the second half of 2023 was entirely of the Fed’s making!

There is no long-term policy that the Fed has not abandoned… In the early days of COVID-19 – 2020 and 2021, “inflation was transitory, and rates were only to be gradually increased in 2024”. That policy was scrapped, and now we are at a “higher rates for longer” policy.

All those dramatic policy changes have caused Treasury bonds to trade like junk bonds with an annualized implied volatility of nearly 20% for over three years! We find it ironic that the COVID-19 scare has faded, stock markets have recovered, and semiconductor shortages have been resolved. However, the one thing that has stayed constant since the spring of 2020 is Treasury market volatility!

Grade: Fail!

Key Takeaway

It is our opinion that the Federal Reserve, under the Chairmanship of Mr. Jerome Powell, is doing an unsatisfactory job at fulfilling their three mandates – price stability, full employment, and low volatility of long-term interest rates. While most people blame the Fed for the inflation in the last two years (we think the criticism has some merit but is not justified), we believe the biggest failure of the Fed is the increased volatility of long-term interest rates!

The cost of this increased volatility is difficult for most consumers to see or measure, but it is pretty accurate – and the price is not always monetary but human as well.

Those costs include the following: higher mortgage and car loan rates, failure of poorly capitalized or poorly supervised banks (an increase in bank fees pays bank failures), increase in personal and corporate bankruptcies, higher divorce rates (correlated with personal bankruptcies), and higher mortality rates (associated with personal bankruptcies).

Get the trading edge you need in today’s markets – sign up for our monthly newsletter featuring in-depth expert analysis, hot market insights, and exclusive trading strategies.