Gold: Trend Is Not Your Friend Forever

We covered gold a few weeks ago, back in September, in our piece Copper vs Gold as an Inflation Hedge. But the recent spike in volatility has put precious metals back in the spotlight — and it’s time to revisit the story.

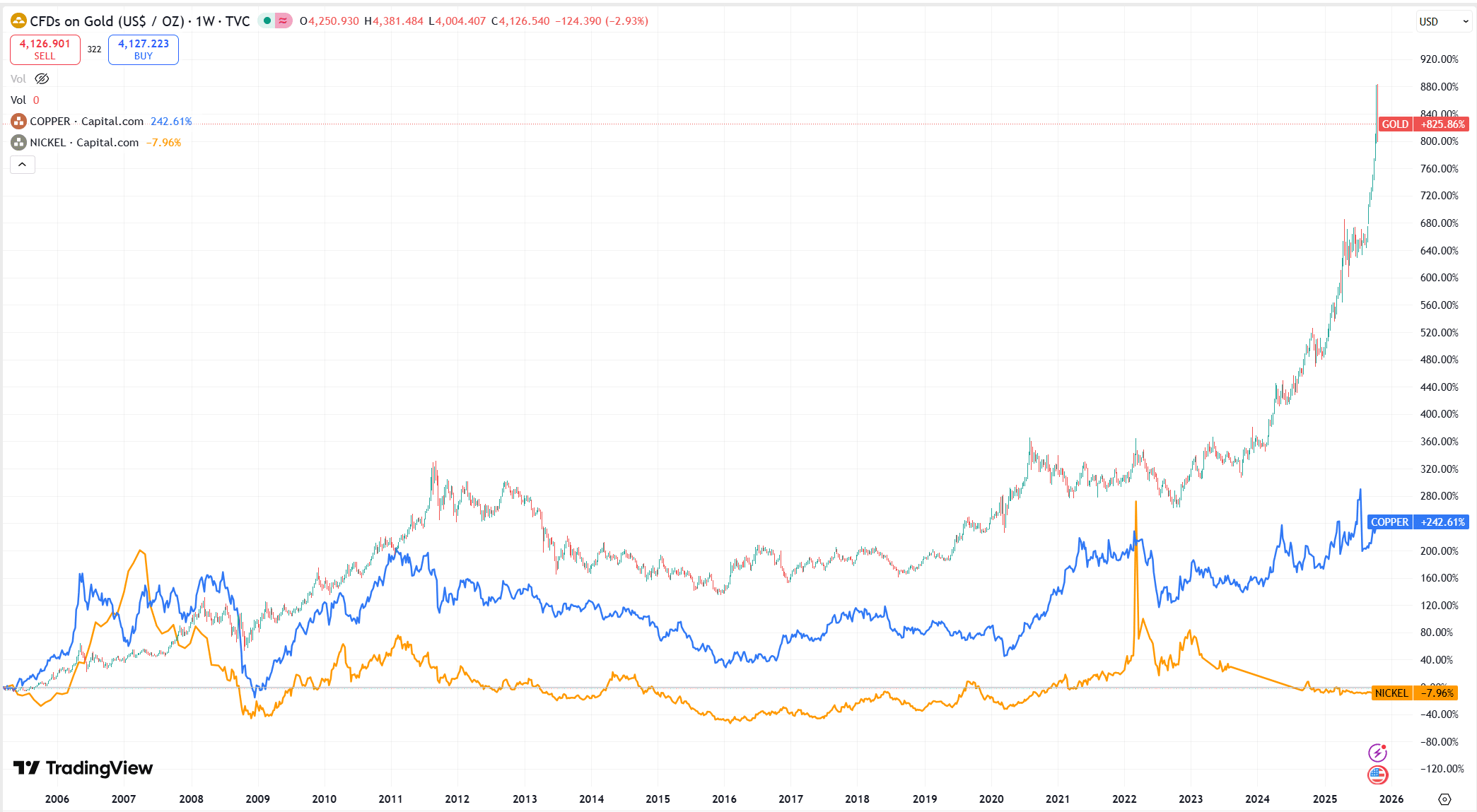

Let’s take a look at a 20-year chart of gold, copper, and nickel, courtesy of TradingView:

These three metals were chosen because they’re global commodities with deep futures markets and long price histories. Fundamentally, any inflation should raise production and extraction costs across all metals, meaning investors should consider multiple hedges — not just gold.

As our readers can see, until early 2025, the three assets moved largely in sync, as they typically do. But starting this spring, both gold and copper began outperforming nickel — and by September, gold took off, jumping from around $3,300/oz to over $4,300, a nearly 30% gain, while copper and the nickel prices barely moved.

That divergence is unusual — and historically, it rarely ends well.

Observation 1: Gold Looks Overvalued

Metals like copper and nickel have apparent industrial demand. Gold, by contrast, is primarily valuable as a store of value. At current levels, buying gold is not an inflation hedgeрр; it’s a bet that the precious metal will continue to outperform inflation by a wide margin.

According to the St. Louis Fed, five-year inflation expectations are ~2.3% annually. Are gold investors here really looking for a 2%-3% return above inflation over the next 5 years?

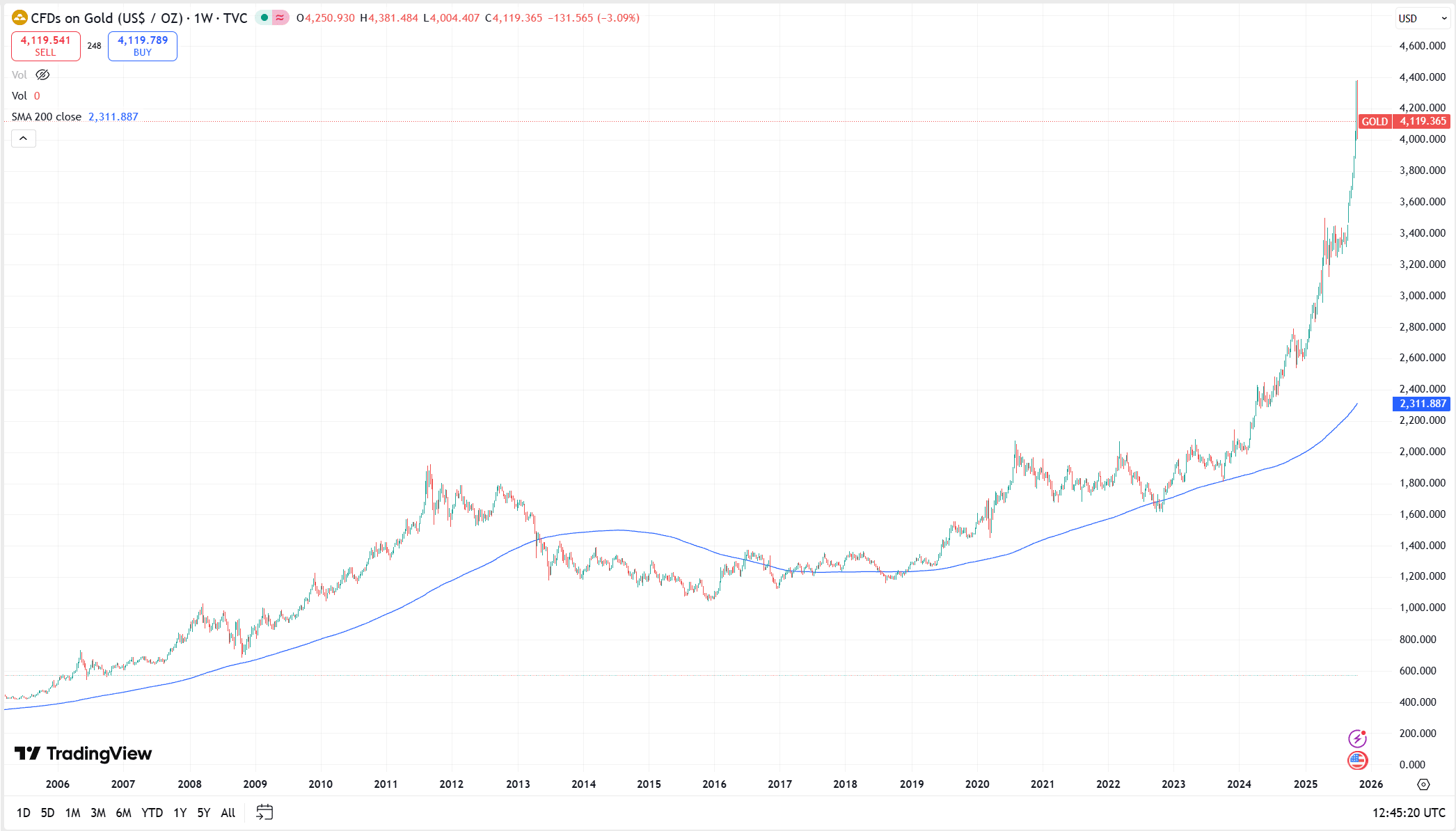

Now look at gold’s long-term chart, courtesy of tradingview.com

Observation 2: Déjà Vu — The 2011 Parallel

The current price of $4,000 sits roughly 75% above its 4-year moving average of $2,300. That gap — as large as it seems — is almost identical to the 2011 peak, when gold traded at $1,900 versus a 4-year average of $1,100 (a 72% spread).

Back then, buyers’ panic gave way to a long, grinding correction. Gold lost nearly 50% of its value in the following years.

The Bottom Line

Gold today looks very much like a late-cycle bubble. Prices are over 70% above the long-term trend, while base metals like copper and nickel are relatively cheap. If you’re genuinely looking for an inflation hedge, copper or nickel, especially, may offer better value.

A replay of 2011-2012, sideways volatility followed by a sharp drop, is not just possible, it’s probable. Given the current disconnect between gold and industrial metals, the correction could even be deeper this time.

The truth is simple: gold, like everything else, is cyclical and mean-reverting. It trends — until it doesn’t. Periods of exceptional performance are invariably followed by reversion.

Buying gold at these levels is like playing last week’s winning lottery numbers:

You might win again, but the odds are stacked against you.