Going for Glitter? Gold Alternatives Shine Brighter

Gold has recently dominated financial headlines, reaching record highs and being hailed as a haven during inflation and global unrest. However, after a stellar run since mid-February, the luster seems to be fading with a significant price correction. This begs the question: is the gold rally sustainable, or is it time to explore gold alternatives?

This article explores the potential investment options beyond the traditional gold standard. We’ll examine the current gold spot price to understand the market shift.

Gold prices have indeed surged in 2024, with a year-to-date increase of 15% and a staggering 100% gain over the past decade. Gold bulls are having a blast in 2024. That begs the question – does the rally have legs? Could gold continue to go up and up?

Of course, it could; we feel that it may be unwise to buy at current levels. It could be a good idea, but we will look for better alternatives.

Gold Alternative 1: CHF – The Swiss Franc

The idea of buying gold gains much credibility from most central banks’ policies of targeted 2% annual inflation. Even though that target may appear small, over the long run, it does lead to quite the depreciation of most fiat currencies, significantly if it is exceeded over some short periods like 2021-2022.

The Swiss National Bank (SNB) has traditionally targeted much lower inflation – around 1% per annum. That makes it a bit “goldish” – a store of value relative to other major currencies like EUR and USD.

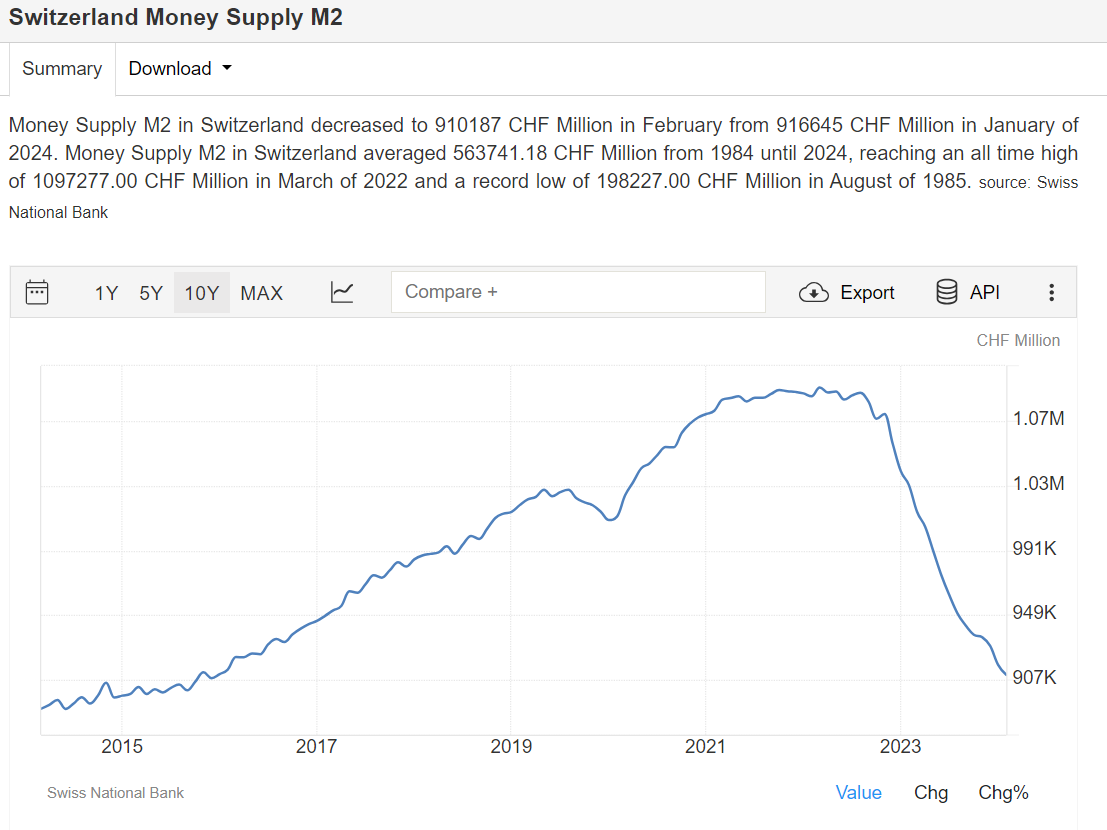

The question is, will they achieve that? Here is a graph of Switzerland’s M2 supply over the last 10 years:

The SNB seems to have unwound all the monetary excesses post-COVID, and M2 supply is at a level much similar to that of 10 years ago. That fact alone leads us to believe that inflation in Switzerland will be pretty contained in the foreseeable future, probably closer to their historical inflation of 1% per annum.

We can revise that target even lower, considering the 10-year interest rate in CHF is at 0.7% annually (not pictured), and the 10-year rates have historically been around the historical inflation levels.

What about the price right now? Here is a 10-year chart of CHFEUR (long CHF, short EUR).

CHF has gained 25% against the EUR over the past decade and is down 4.6% year-to-date. In our view, these levels offer an attractive opportunity, positioning the CHF as one of the strong gold alternatives to consider.

Gold Alternative 2: Platinum – A Precious Rival

Gold and platinum prices have behaved similarly over the last 50 years (and even longer). That should not be a surprise – both metals are precious metals with similar qualities and uses. Both have industrial and jewelry applications and a store of value for coins and bars. Yes, there are platinum precious metal bars and coins.

Gold has a much longer history as a store of value, while platinum has mostly jewelry applications. Still, the fundamental connection between the two metals has existed for centuries.

That is, until recently, maybe in 2016, gold prices began to outperform platinum prices. So much so that while platinum has historically been more expensive than gold, it trades at a 50% discount. For our customers interested in purchasing platinum, we offer investments in ETFs and physical platinum assets – coins and bars (just like gold). Given these dynamics, platinum emerges as another of the strong gold alternatives to consider.