PDD Holdings Stock: Revisiting the Case at $100

We have written positively on PDD Holdings stock before, most recently in December 2024, when we argued that PDD at 107 USD per share looked attractive. About a month later, the stock rallied to the 130–140 USD range, but over a year later, it had returned to around 100 USD.

This prompted us to revisit the story.

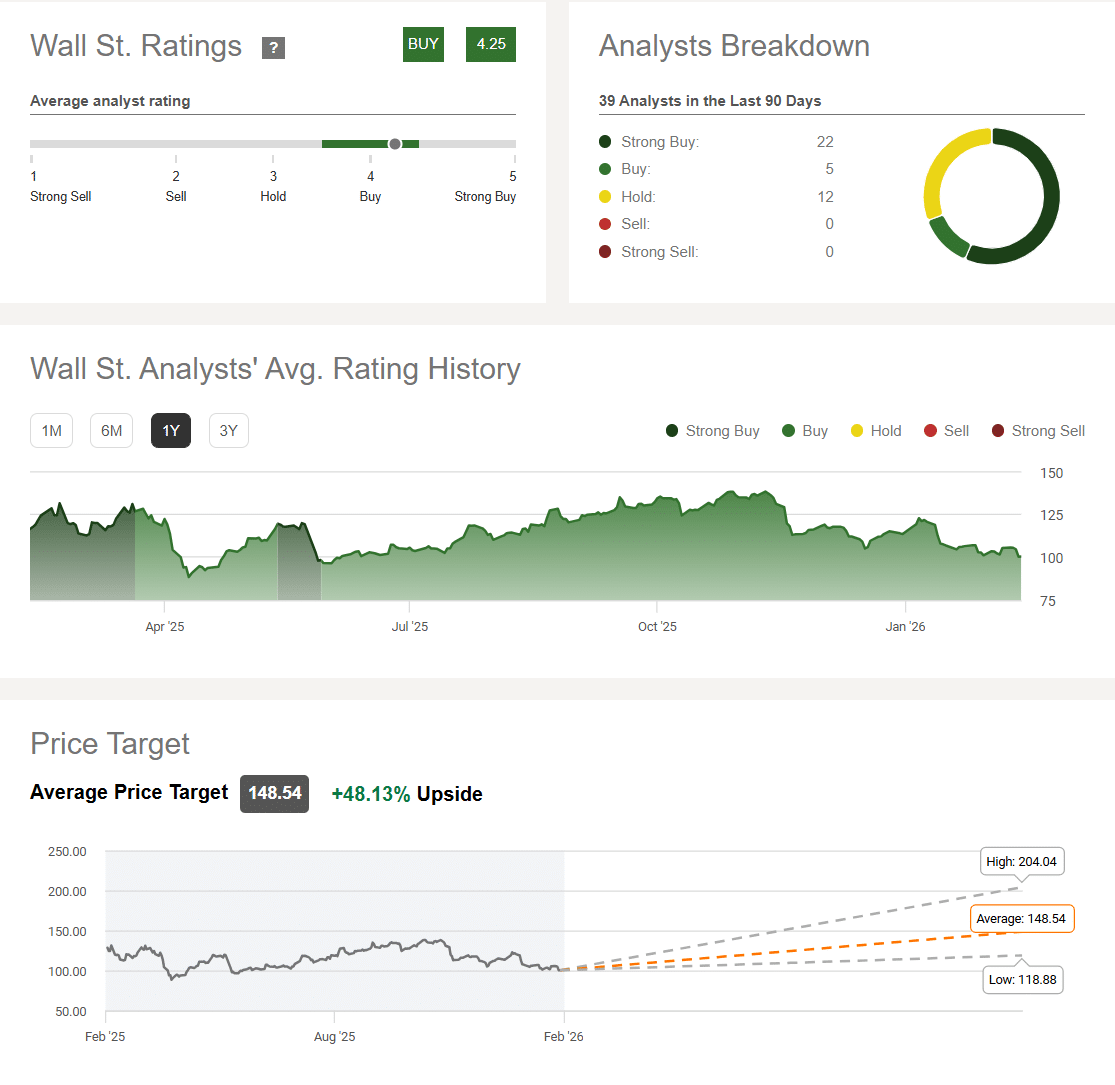

Analyst Consensus: Wide Gap to Price Targets

Let’s start with analyst estimates (courtesy of SeekingAlpha.com)

With the stock trading near 100.28 USD, the average analyst price target of 148.54 USD implies roughly 48% potential upside. The lowest price target, at 118 USD, still suggests about 18% upside from current levels. There are currently no Sell or Strong Sell ratings; 27 of 39 analysts rate the stock Buy or Strong Buy, and the remainder Hold.

In our experience, large, well-followed companies rarely trade at significant discounts to consensus price targets for extended periods. PDD Holdings stock appears to be trading near the lower end of its typical analyst-implied valuation range.

That said, there’s a caveat. Analyst coverage of Chinese ADRs can carry a structural optimistic bias — analysts who turn bearish often drop coverage rather than issue Sell ratings, and the absence of Sells should not be read as unanimous conviction. Consensus targets on names like Alibaba and JD.com have similarly overstated upside for extended periods since 2021. The gap to target is notable, but it is not unique to PDD within this category.

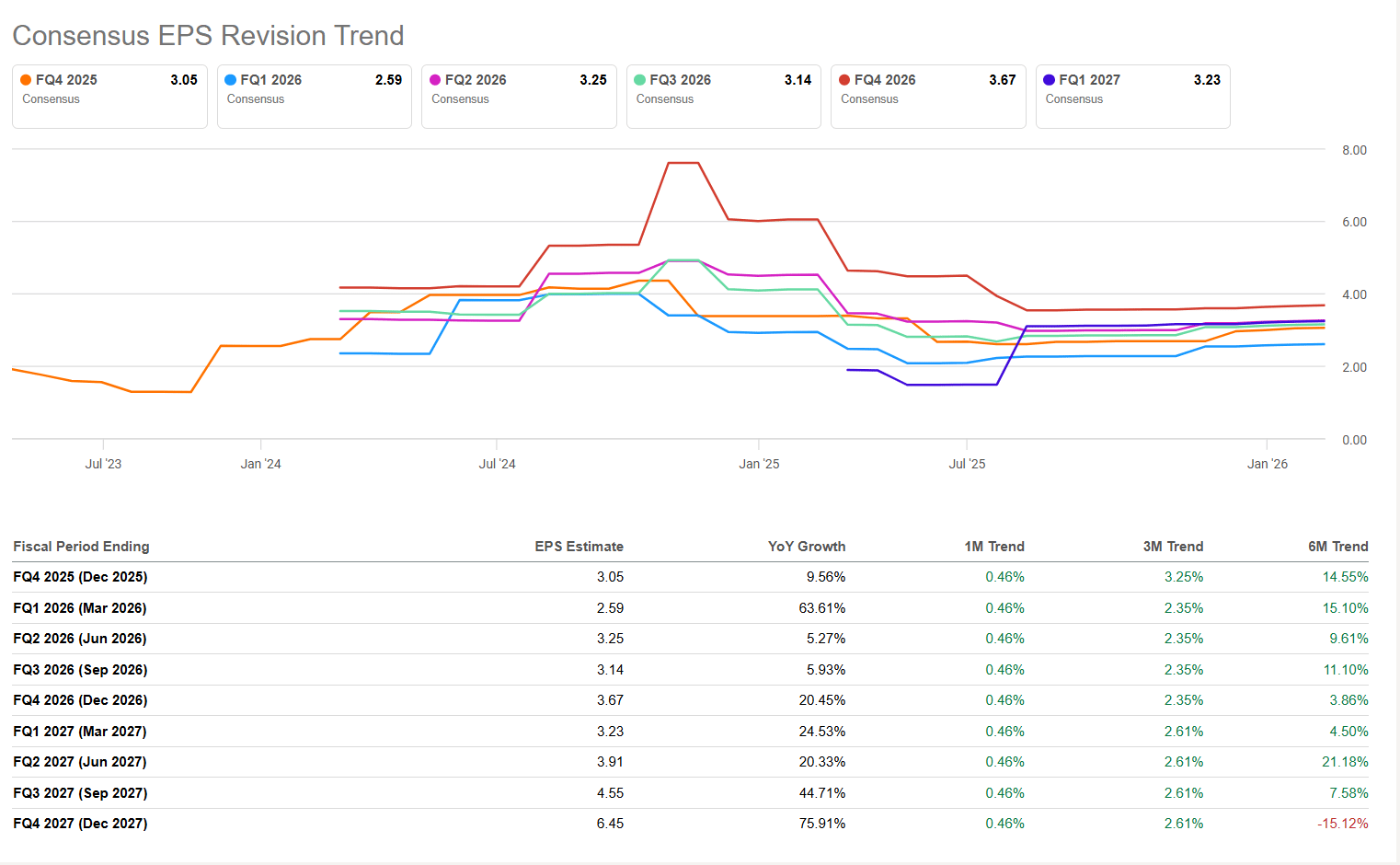

Earnings Revisions: Stability Under the Surface

The stock is down roughly 10% year-to-date and about 27% over the past three months. A natural question is whether earnings expectations have deteriorated. Looking at quarterly earnings revisions (again via SeekingAlpha), estimates for the next two years appear broadly stable, with some modest upward adjustments.

This is arguably the most compelling data point in the current setup. When a stock drops 27% while forward estimates hold steady or improve. It typically signals that the move is sentiment-driven rather than fundamentals-driven.

However, headline EPS stability can mask meaningful shifts beneath the surface. PDD’s earnings are driven by two distinct engines: the mature domestic Pinduoduo platform and the fast-growing but cash-intensive Temu international business.

A tariff escalation or regulatory action targeting cross-border e-commerce could materially impair Temu’s growth trajectory while leaving domestic operations — and near-term aggregate estimates — largely intact. Investors should consider whether the consensus adequately reflects tail risks to the international business, or whether current estimates embed an assumption of continued Temu expansion that may not materialise.

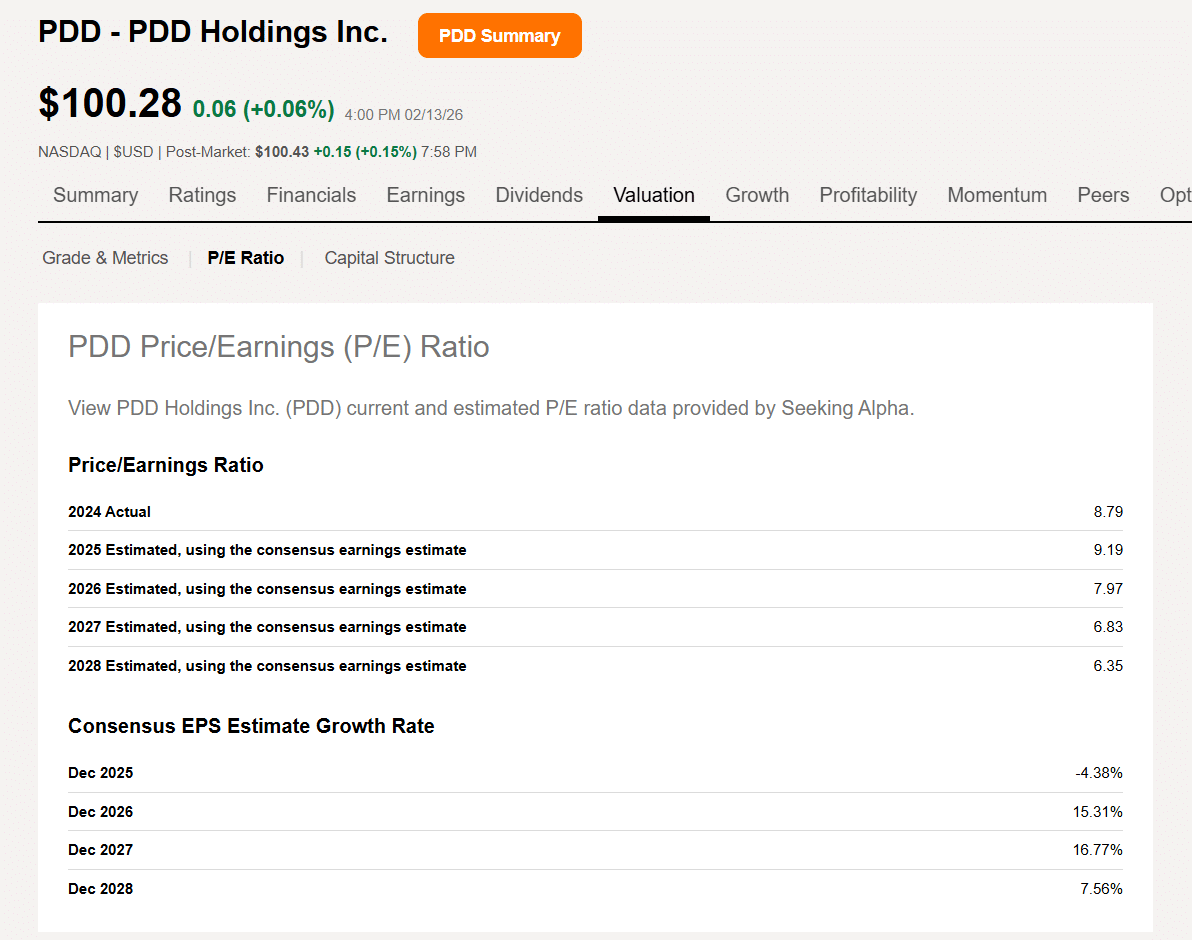

Valuation: Cheap, Compared to Peer Group

If estimates are stable, one might ask whether the valuation was previously stretched. On that front, the 2026 forward P/E of around 8, against expected low-teens earnings growth, does not appear demanding on the surface. By comparison, the S&P 500 trades near a 2026 P/E of roughly 24 with mid-teens growth expectations.

On this basis, PDD trades at a notable discount to the broader market.

However, comparing a Chinese ADR to the S&P 500 conflates very different risk profiles. A more informative benchmark is PDD’s own peer group.

Alibaba currently trades at roughly 10–11x 2026 earnings, JD.com near 8–9x, and Meituan around 18–20x. Against these peers, PDD’s discount is less dramatic — it is cheap within a cheap cohort, which tells us more about the market’s pricing of China risk broadly than about PDD-specific mispricing. That said, PDD’s earnings growth profile justifies a premium to BABA and JD, which are growing more slowly.

Short Interest: Limited Signal

Short float stands near 1.92%, within its historical 1–3% range. This suggests there is not a large build-up of outright bearish positioning, though short interest alone does not capture the full spectrum of investor views.

Short interest is a particularly weak signal for Chinese ADRs. Borrowing costs for these names tend to be elevated, the Variable Interest Entities (VIE) structure introduces additional risk for short sellers, and institutional investors more commonly express bearish views through options strategies, reduced position sizing, or simply avoiding the name altogether. The absence of elevated short interest is not especially reassuring in this context.

Key Takeaways

Relatively low valuation multiples, stable earnings estimates, modest short interest, and a meaningful gap to analyst targets suggest that PDD Holdings stock may offer value at current levels. The quantitative setup is attractive for investors willing to underwrite China risk.

At the same time, persistent discounts in Chinese equities often reflect macro, regulatory, and sentiment factors that have proven durable. The key question is not whether PDD is cheap — it clearly is — but whether the potential return adequately compensates the risks embedded in that cheapness.

For investors with a higher tolerance for geopolitical and regulatory uncertainty, the risk-reward at 8x forward earnings appears skewed to the upside. For others, the same discount may reflect a rational pricing of unresolvable risks.