Are the Odds of a Recession in 2026 Increasing

There is a joke among economists that if you try to predict recessions, you will correctly predict 12 of the following 6. In other words, recessions are largely unpredictable or, at the very least, difficult to time precisely. Nevertheless, it is still helpful to examine the current business cycle

through the lens of historical data.

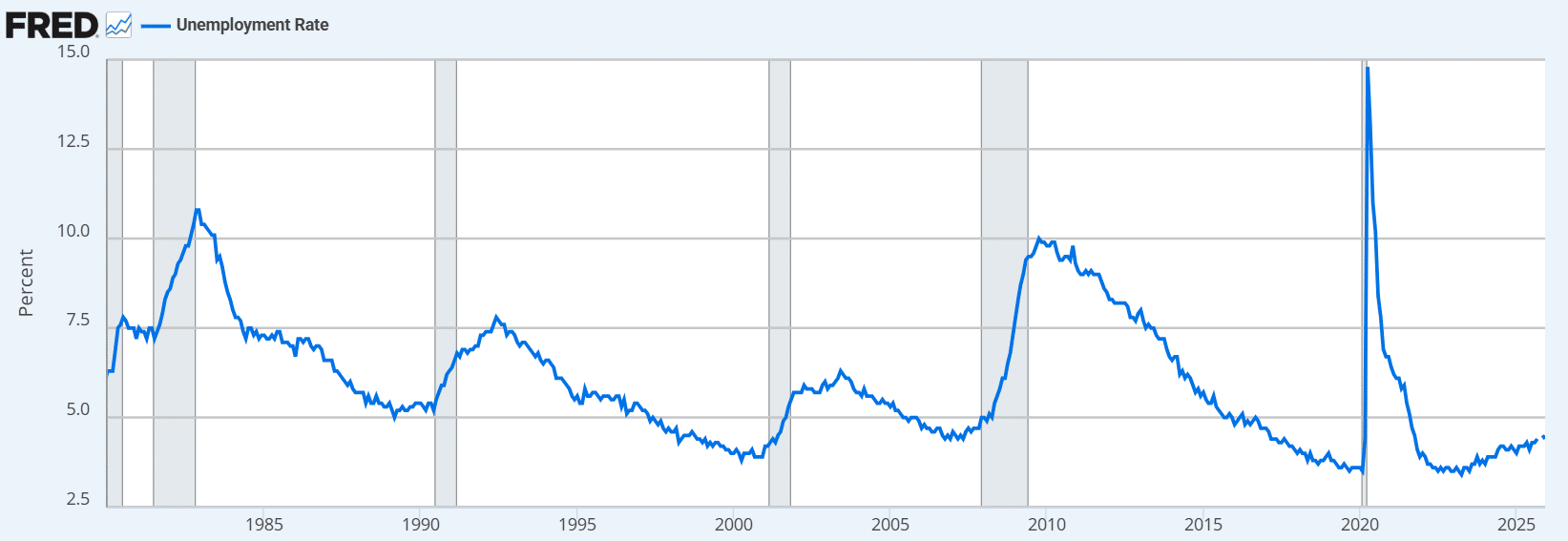

Using data from FRED, let us begin with the U.S. unemployment rate over the last 45 years.

Although unemployment data is available from 1948 onward, we restrict our analysis to post-1982 for several reasons:

- Marginal tax rates before 1980 were materially higher

- The Federal Reserve operated with far less transparency

- The full employment mandate was added only in 1977

- Before that, the Fed’s primary responsibility was inflation control

Key Observations

- There have been four completed business cycles since 1982, excluding the current one:

- Nov 1982 – Jun 1990

- Mar 1991 – Mar 2001

- Nov 2001 – Dec 2007

- Jun 2009 – Feb 2020

- The lengths of these cycles were approximately 8, 10, 6, and 11.5 years, respectively.

- Average: 8.75 years

- Range: 6 to 11.5 years

- In three of the four cycles, the peak occurred when unemployment fell well below 5%, reaching extremes near 3.5%.

- Unemployment displays strong cyclicality:

- When rising, it tends to keep rising

- When falling, it tends to keep falling

Where Are We Now? Assessing the Odds of a Recession

According to the Bureau of Labor Statistics, the current business cycle began in April 2020, nearly six years ago.

- Unemployment bottomed in April 2023 at 3.4%

- It hovered near 4% throughout most of 2024

- In November 2025, it reached a new three-year high of 4.4%

This shift in direction matters.

Non-Farm Payrolls: A More Concerning Signal

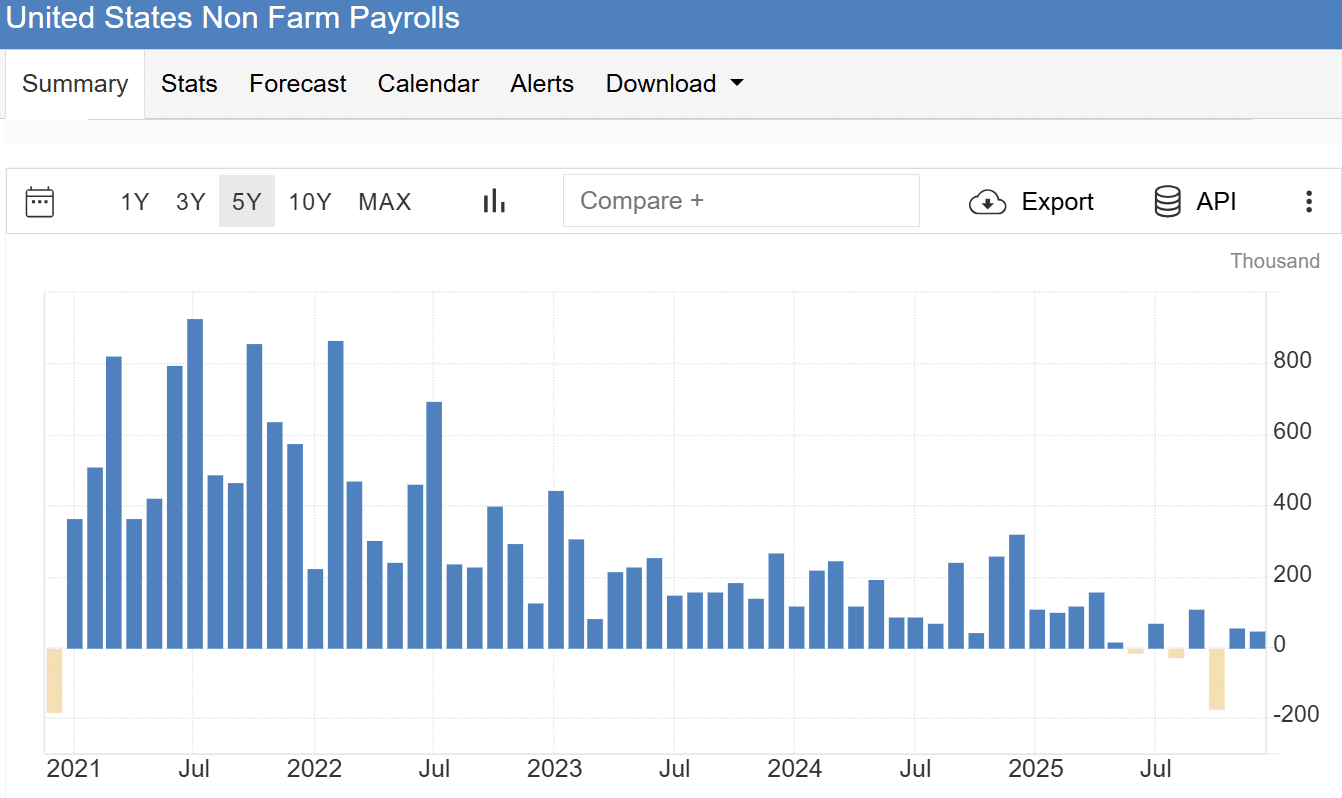

Let us now examine non-farm payrolls over the past five years, using data from Trading Economics.

The picture here is more troubling:

- Over the last six months, net job creation has been essentially zero

- During 2023–2024, monthly job gains typically ranged from 100k to 200k

- Between 2015 and 2019 — a period with a similar unemployment rate — the U.S. never recorded a month of net job losses

- In 2025 alone, we are already observing multiple months of outright job losses

Six months is not a trivial period. More importantly, this labor market weakness has occurred despite solid headline growth data.

Historically, prolonged stagnation in non-farm payroll growth has coincided with rising odds of a recession, even when headline GDP growth remains positive.

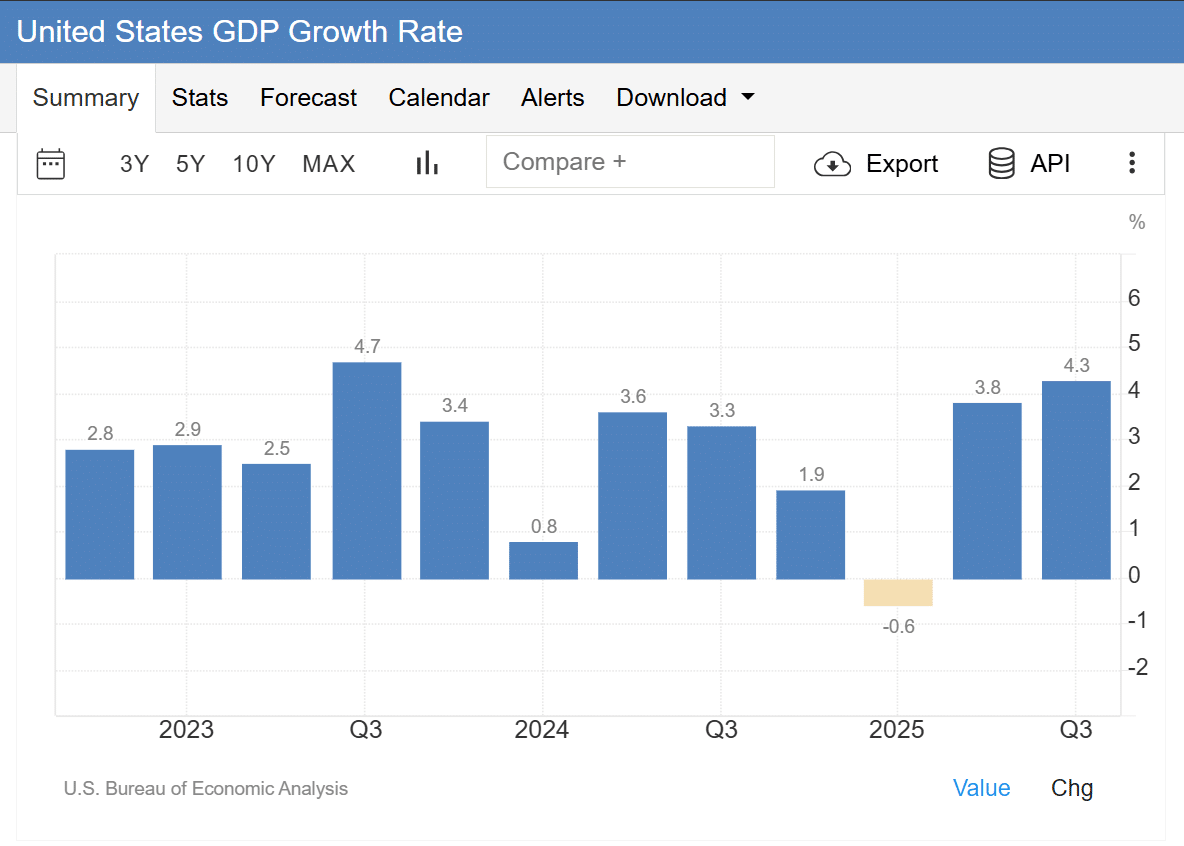

The Growth–Jobs Disconnect

Yes, President Trump’s tariffs weighed on growth in Q1 2025 (-0.6%), but Q2 and Q3 were powerful.

Q3 2025 was among the strongest quarters in recent years — yet job creation remained stagnant.

This divergence is critical.

Looking ahead, the International Monetary Fund forecasts U.S. GDP growth of ~2% in 2025. It is difficult to argue that growth at this pace will meaningfully support job creation in 2026, particularly if labor demand is already stalling at higher growth rates.

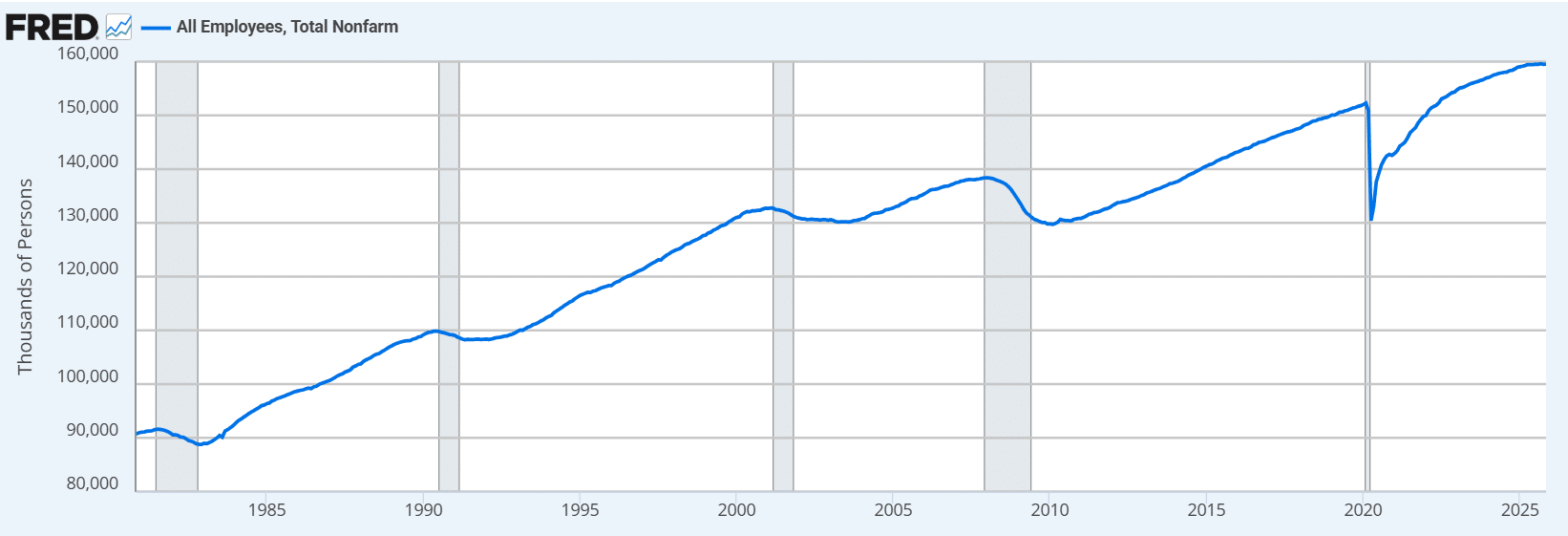

Another helpful perspective comes from historical data on All Employees, Total Nonfarm Payrolls, courtesy of FRED:

In prior business cycles, when total non-farm employment stopped growing, a recession invariably followed. We appear to be entering such a phase now. According to the BLS, total non-farm employment peaked in September 2025 at 159.593 million and declined to an estimated 159.526 million by November 2025. Given the December 2025 non-farm payroll report of 50k, we can extrapolate that December employment likely reached approximately 159.576 million.

In other words, total U.S. employment declined by roughly 20,000 over the final quarter of 2025.

This does not imply that a recession is inevitable — only that, in previous cycles, similar dynamics ultimately preceded one.

Conclusion

A weakening labor market is not a foolproof recession signal, but it is a serious red flag.

- Unemployment has likely turned

- Job creation has stalled or reversed

- Growth is becoming less labor-intensive

- The cycle is already long by historical standards

Taken together, these factors suggest that while a recession is not inevitable, the odds of a recession in the near future, including 2026, have increased meaningfully.