Are We Headed for a Stock Market Correction in 2025

A colleague once lamented that every time his relationship with his wife seemed to be going well, something would happen, and suddenly there would be a lot of crying involved.

That got me thinking: just like relationships, markets also go through cycles of calm and conflict – often ending in a stock market correction when complacency reaches an excessive level.

Just as couples inevitably reach moments of tension, markets eventually experience their own shake-ups. The longer things stay calm, the more likely a stock market correction becomes.

Echoes of 2021: Lessons Before the Next Stock Market Correction

Today’s market feels eerily similar to the euphoric top of 2021. Chinese meme stocks are soaring, and the VIX is scraping record lows — a sign that investors have become unusually comfortable with risk.

For readers interested in how volatility shapes market behavior, explore our explainer on the VIX Volatility Index Term Structure.

Back in 2021, the consensus was that interest rates would rise, but only modestly, not enough to end the uptrend. We all know how that ended: rates went far higher than expected, triggering a sharp market correction and erasing much of the optimism.

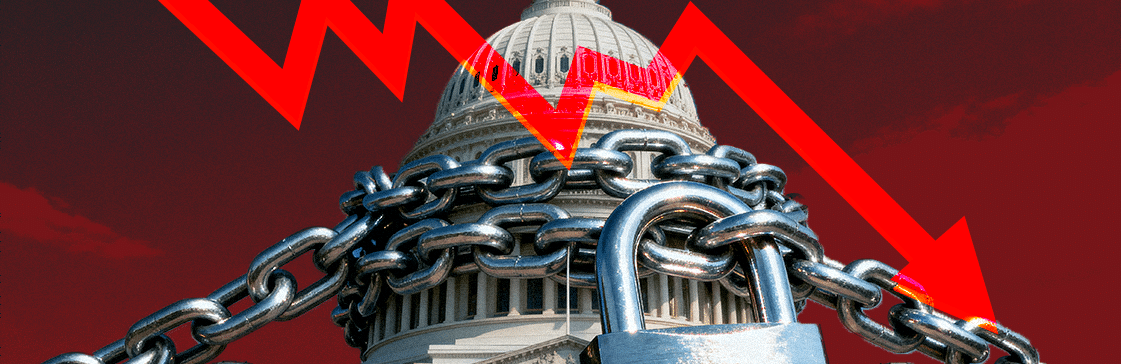

Could a Government Shutdown Spark a Correction

The narrative today feels familiar – investors expect the government shutdown to be short-lived, even though it’s far from ideal for market

But what if it isn’t? What if it lasts more than a month — maybe into Thanksgiving?

A prolonged shutdown could delay key economic data, dampen consumer spending, and dent confidence — the perfect conditions for a stock market correction to unfold.

While previous shutdowns caused only short-term volatility, today’s environment feels more fragile. With high valuations and record-low volatility, even a modest shock could trigger a deeper market correction in 2025.

Lessons From Market Psychology

Markets, like relationships, have a rhythm of calm and conflict. When volatility remains suppressed for too long, tension builds beneath the surface.

That’s what we’re seeing now: speculative behavior returning, risk perception fading, and investors assuming that this time is different. Historically, that’s precisely when deep corrections emerge.

Could we see a stock market correction before the end of 2025?

History, psychology, and complacency all suggest it’s not just possible- it’s increasingly probable.

When everyone assumes the calm will continue, that’s usually when the following storm forms.