US Jobs Report: January 2024 – Behind the Numbers

The US Jobs Report, released monthly, is a vital tool for gauging the health of the American economy. It offers a snapshot of employment trends, revealing insights into job growth and unemployment rates.

After releasing the January 2024 US Jobs Report, traders are eager to dissect the freshly unveiled data. We sit down to address their questions and provide insights into the implications of the latest statistics.

Q: The January jobs report was nearly twice what the market expected – the actual jobs created in January were 317k, while expectations were for 155k. Also, December 2023 numbers were also revised to be much higher. Initial estimates were 164k jobs, which are being revised to 278k jobs. What do you make of it?

A: It is essential to understand precisely how those numbers are calculated. The jobs report in any given month is estimated based on actual hirings for large companies and projected hirings for small and medium-sized companies. Given that small businesses, as a group, are the largest employers in the US, you can clearly see that the majority of those jobs reported as created in any given month are not confirmed hirings but rather “theoretical” hirings.

Hence, there is a significant adjustment in the December 2023 job data. The good news here is those 317k jobs created for January 2024 are, again, most likely, theoretical – they can be adjusted up or down by a large margin.

Q: Given that Mr. Powell has been concerned about the strength of the US job market, do you think those bullish employment numbers change anything for the Fed?

A: It is essential to remember that even before the data, markets were not expecting the FED to do anything before May 2024. While the January employment numbers will be significant, let’s keep in mind that we have at least 2-3 months of employment and inflation data before the FOMC’s May meeting.

I guess the best answer is – let’s wait and see. I am frankly more focused on actual inflation data rather than the potential for higher inflation due to substantial employment numbers.

Q: Do you think market expectations for lower rates may also not be fulfilled in 2024? There was a time in 2023 when markets were projecting the Fed lowering rates, but that did not happen. Can something like that happen again in 2024?

A: The most crucial thing about interest rates is that interest rates are unpredictable. What is predictable, however, is inflation levels, and one can extrapolate from those inflation levels what interest rates can be expected to be. It sounds counterintuitive and in contrast to what you hear or read.

However, in my experience, nobody is good at predicting what the Fed will or will not do.

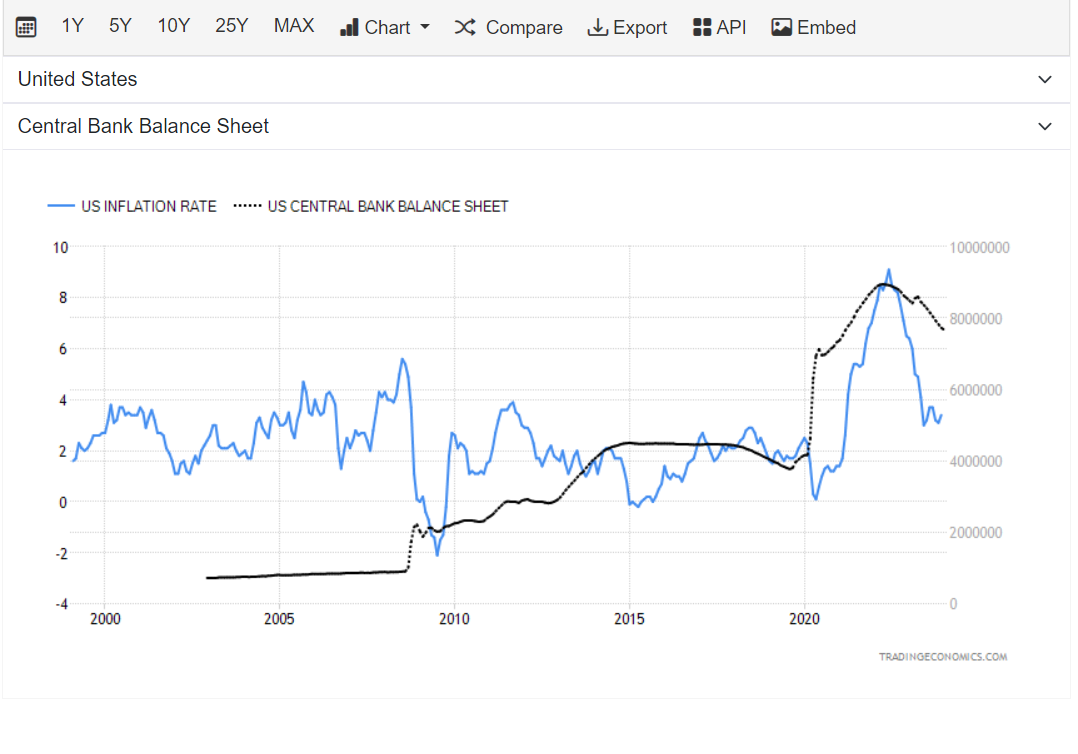

That being said, one of the significant determinants of inflation is the size of the Central Bank Balance sheet. Here is a 25-year chart of the relationship between inflation in the US and the Fed’s balance sheet:

Inflation is pictured in blue and measured on the left axis at 3,4%. Fed’s balance sheet is currently at 7,63 trillion. USD, down from over 9 Trillion USD.

Yes, the Fed is serious about fighting inflation, as evidenced by the fact that they have contracted their balance sheet by nearly 20% since 2022. Anytime in history that the Fed keeps the balance sheet steady or contracts it, eventually, inflation goes down to 2% or lower.

So, to answer your question directly, I do not know what the Fed will do in 2024. However, at some point in 2024 or, at the latest, in 2025, I expect inflation to fall down to 2%. To believe otherwise is to think you can gain weight while eating nothing… impossible!

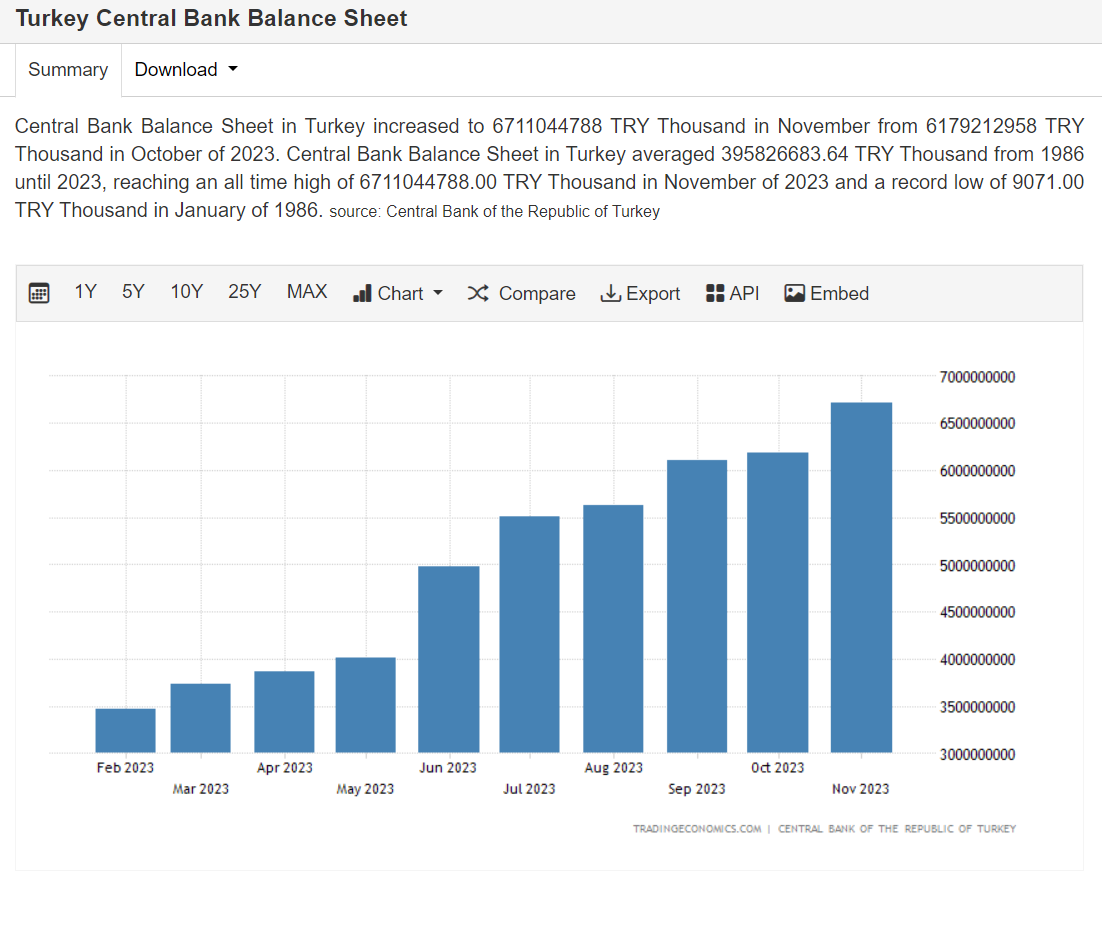

Do you want to see an example of a Central Bank that is not serious about fighting inflation? Look no further than the Turkish Central Bank: