MSTR: A Better Buy Than Bitcoin

Strategy Inc. (MSTR, formerly known as MicroStrategy Incorporated) has been in the news recently, and not always for encouraging reasons. The stock is often described as a leveraged expression of Bitcoin, and recent price movements reinforce that impression. Bitcoin is down roughly 25% over the last three months, while MSTR has fallen nearly 50%. This suggests implied leverage of about 2:1, but analysts disagree. Many maintain that although MSTR uses leverage, the proper exposure is closer to 1:1 than to the ratio implied by market behavior.

Adding to the uncertainty, MSTR may face removal from select MSCI Indexes in January 2026. This is a material possibility but far from a foregone conclusion. With that context in mind, we begin our usual assessment, starting with analyst sentiment based on data from Seeking Alpha.

MSTR Analyst Sentiment, Price Targets & Short Interest

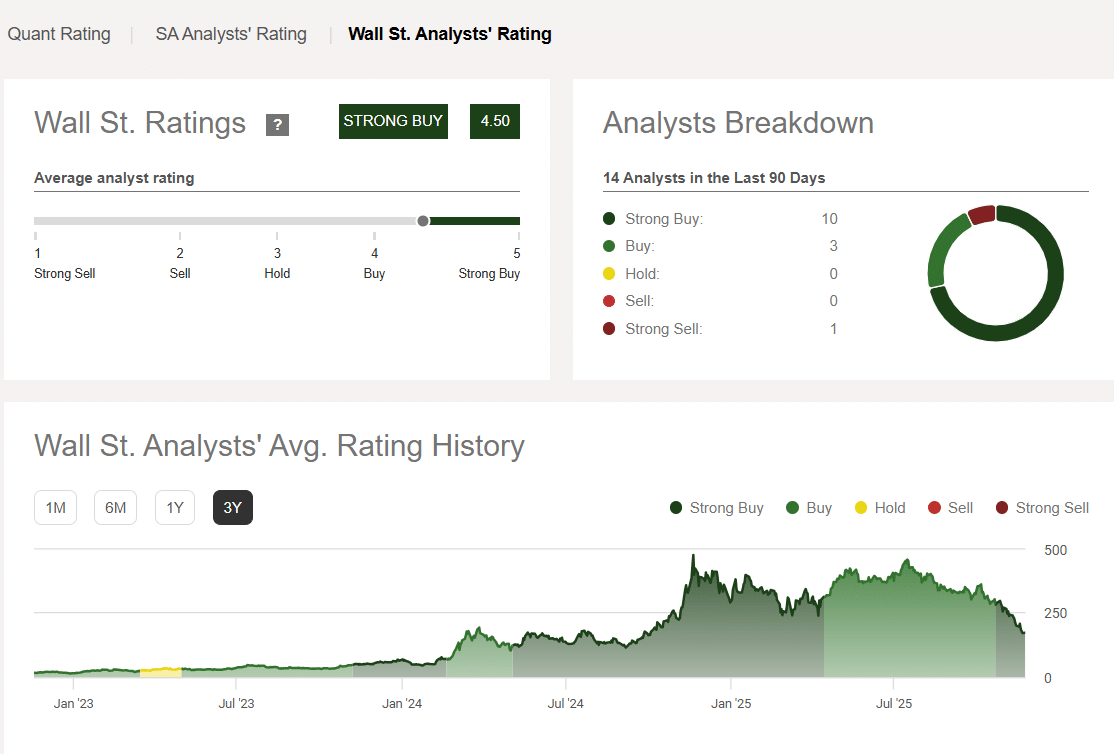

Over the past 90 days, fourteen analysts have issued ratings on MSTR. Most fall into Buy or Strong Buy, with only one Strong Sell. That lone outlier is unusual, though understandable given the company’s unconventional structure. Overall, the consensus rating of 4.5 out of 5 remains exceptionally strong — analysts continue to view the stock favorably at current levels.

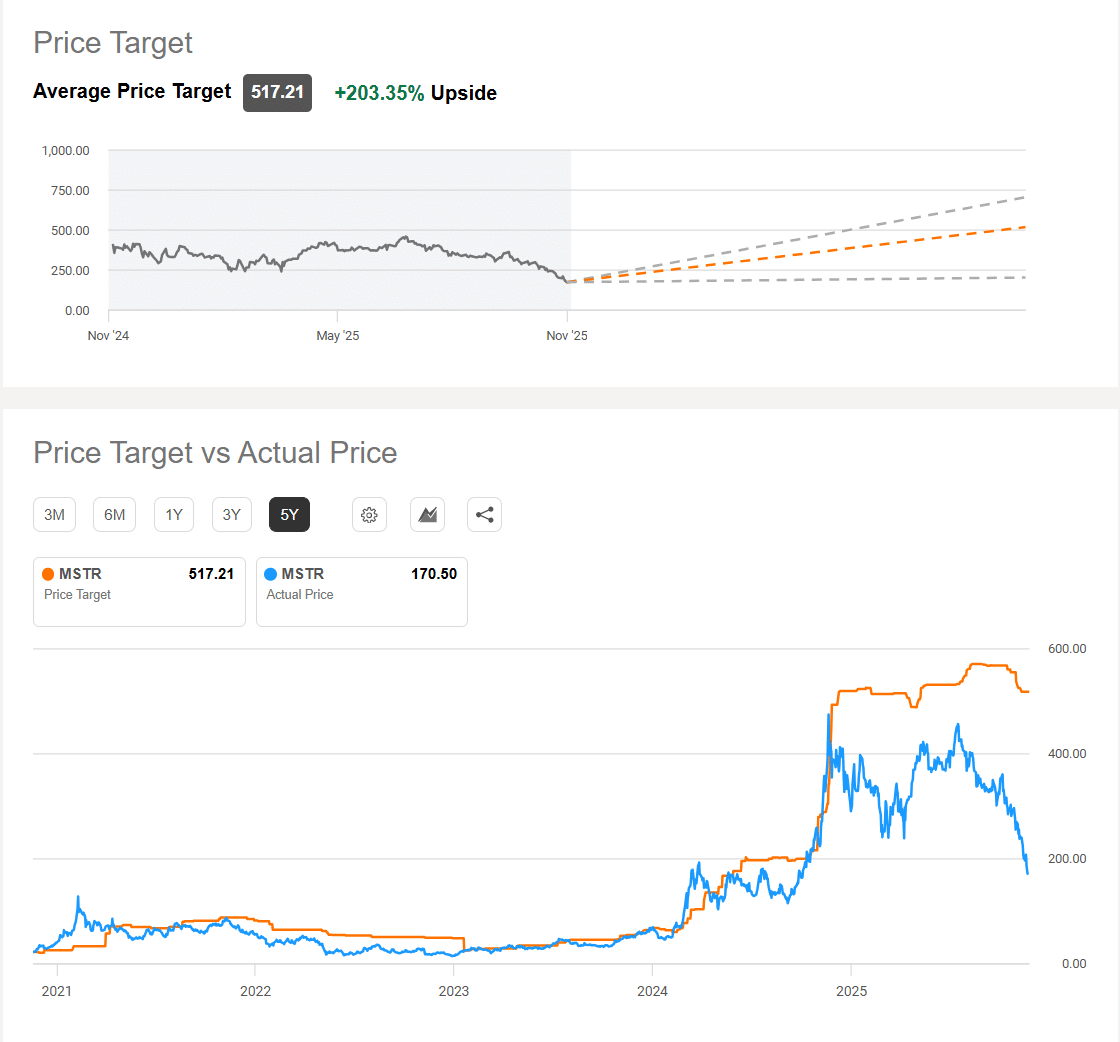

Next, let us consider price targets.

At present, the market price suggests nearly 200% upside to the average analyst target. Yes, MSTR’s disclosures are unconventional. Yes, index-related risks are real. But the valuation gap is unusually wide for a company approaching a $50 billion market capitalization. Such a discount is rare.

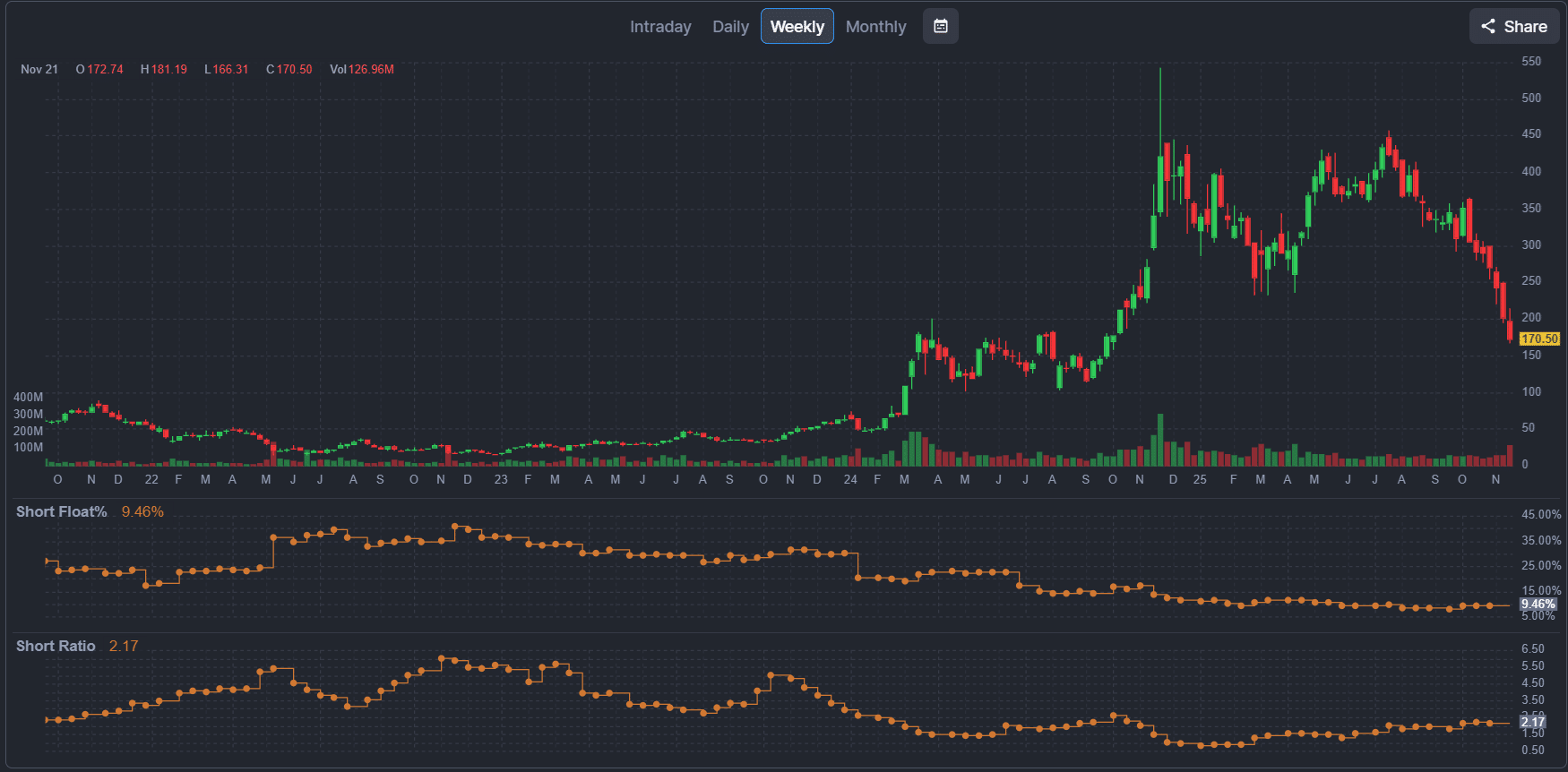

Finally, we examine short interest, using Finviz as reference.

MSTR Long-Term Opportunity & S&P 500 Inclusion Potential

Despite the negative headlines, short float remains below 10%. While we would prefer a figure under 5%, this level is surprisingly moderate given the pessimistic narrative. With concerns about MSCI removal and recent stock performance, one might expect materially higher short exposure. The current figure is not entirely reassuring, but it is more constructive than expected.

Taken together, these data points suggest that while the stock has faced considerable pressure, analysts have not abandoned their positive view — and short sellers have not positioned aggressively against it. This leads to a measured, contrarian conclusion: the upside envisioned by analysts is plausible. It may not materialize quickly, and price targets can certainly be revised, but the current valuation offers a compelling long-term opportunity. For investors considering Bitcoin at these levels, MSTR provides a differentiated path — with leverage, yes, but likely less than the 1:2 ratio the market appears to be pricing in.

It is a common belief that markets are always correct. In our opinion and experience that is not correct – in the long markets tend be correct, in the short-term they can deviate substantially from fair valuations.

In our view MSTR appears quite undervalued and once the current uncertainty subsides, holders of MSTR may see stronger returns than direct Bitcoin investors.

A few months ago, many expected MSTR to join the S&P 500 – a move that would have forced index-tracking ETFs to purchase roughly 3% of the float. The committee bases its decisions on rules, but ultimately exercises discretion. Given today’s negative narrative, inclusion in the near term seems unlikely. However, the probability is not zero, and any future inclusion would further strengthen the long-term bullish case for MSTR.