WTI Crude Oil Prices: A Year in Review

It has been nearly a year since we last examined WTI crude oil prices. For those interested, our initial analysis, “Oil and the S-curve,” remains highly relevant and provides valuable insights into the trends we are observing today.

As a start, let’s take a look at WTI Oil Future prices:

| Future | WTI Price 9/23 | WTI Price 8/24 | Change |

| Dec 2024 | 78,89 | 71,41 | -7,48 |

| Dec 2025 | 73,84 | 68,03 | -5,81 |

| Dec 2026 | 70,02 | 65,82 | -4,20 |

| Dec 2027 | 66,91 | 65,30 | -1,61 |

| Dec 2028 | 64,26 | 64,38 | 0,12 |

| Dec 2029 | 61,94 | 63,42 | 1,48 |

| Dec 2030 | 59,7 | 62,83 | 3,13 |

| Dec 2031 | 57,69 | 62,39 | 4,70 |

| Dec 2032 | 55,81 | 62,02 | 6,21 |

| Dec 2033 | 54,57 | 61,81 | 7,24 |

What we are seeing is a normalization. The WTI futures curve continues to be inverted. Near-term oil futures are more expensive than long-dated futures, but not as much as in 2023. Dec 2024 contract is 7 USD per barrel lower than in September 2023, but December 2033 WTI contract is also 7 USD per barrel more expensive.

Market Interpretation: The Impact of EV Adoption

One interpretation of the move is that the implied adoption rate of electric vehicles globally has decreased.

We guess the slowdown in new Tesla sales is bullish for the market. Bullish is a strong word, but undoubtedly not bearish.

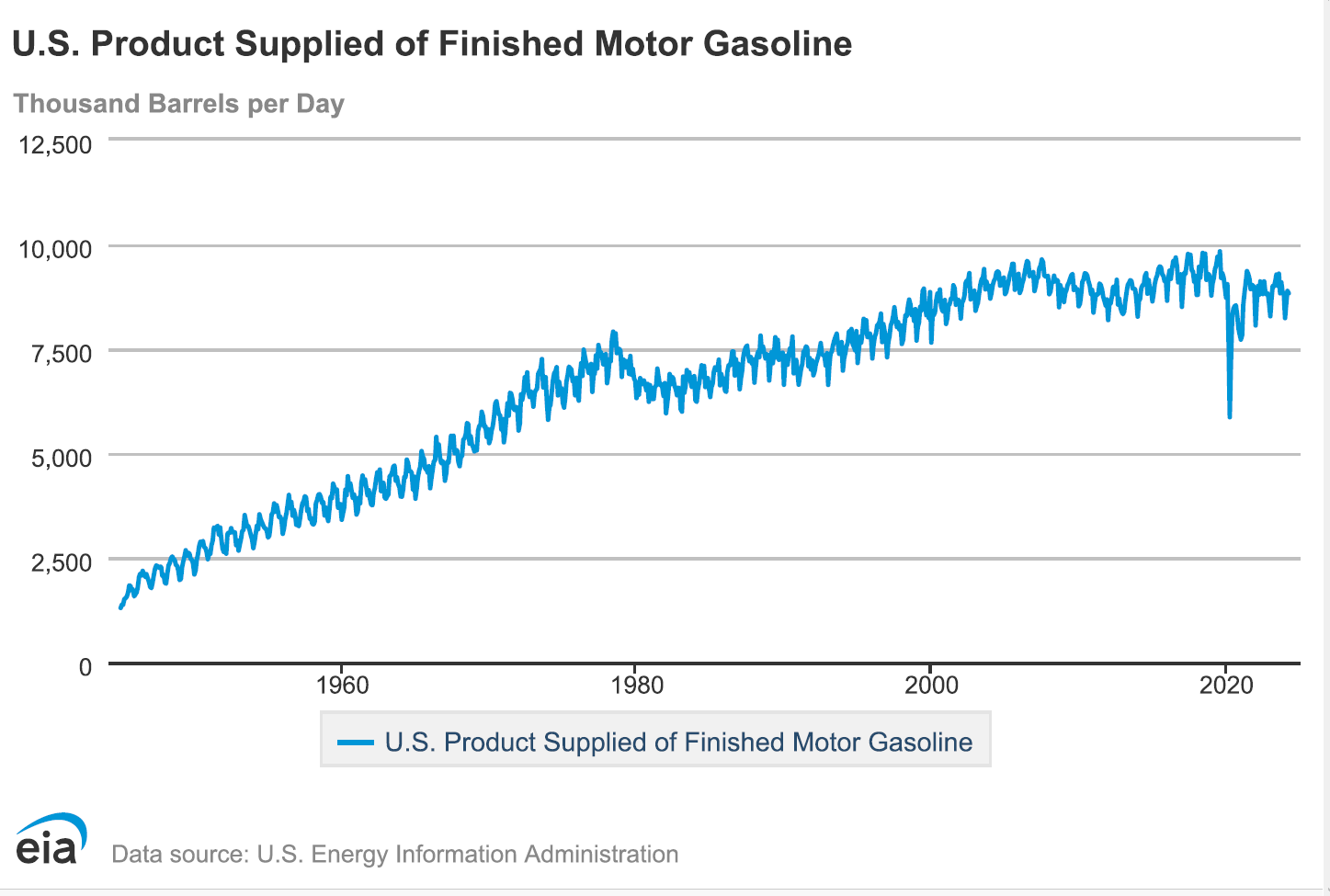

However, that slowdown is just a slowdown, not a drastic change in the trend. Let us give you the historical gasoline consumption in the US, courtesy of the US Energy Information Administration:

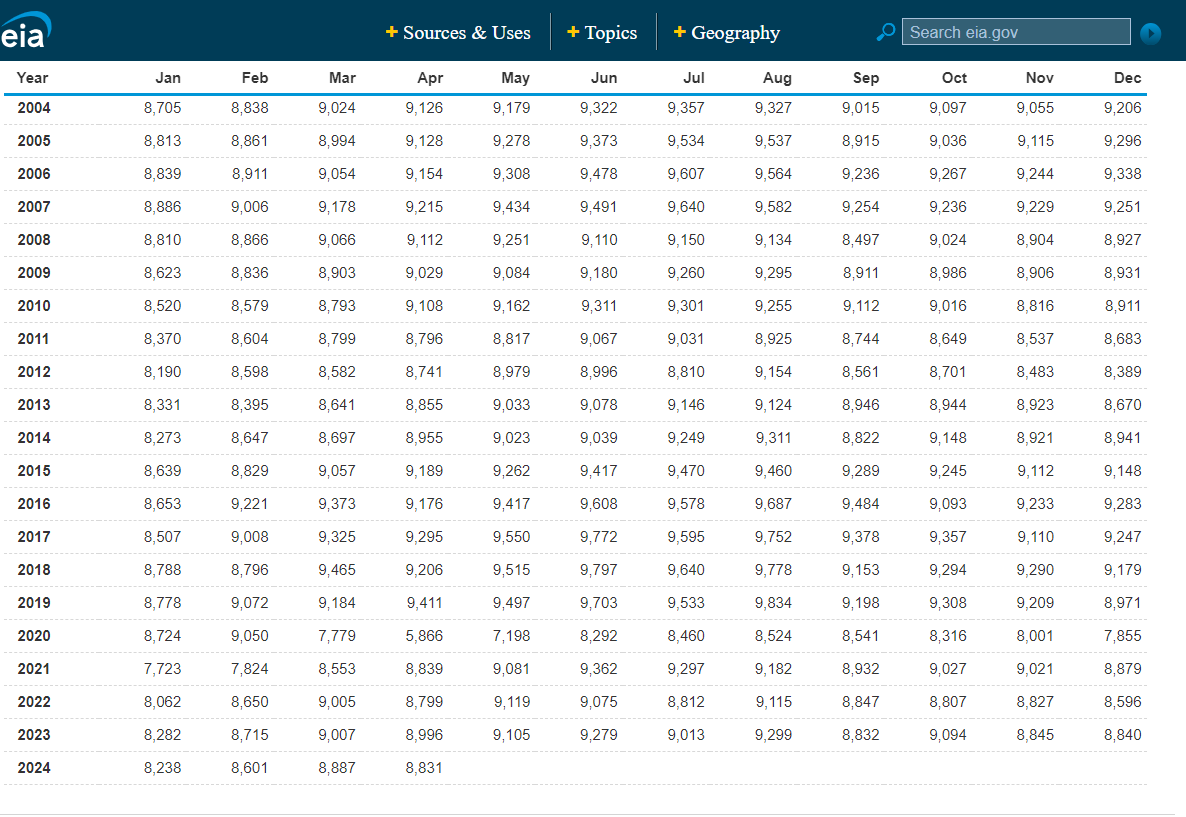

We will focus on the past 20 years, though having data from the preceding 70 years is valuable.

Since May 2024 is the last data, we will focus on May’s historical consumption, which is most likely valid for all months. May gasoline consumption in the US peaked in 2019 at 9411 thousand barrels per day.

That is not necessarily true for all the months – most peaked in 2019, but some in 2018, most likely due to weather/holiday differences. It will be fair to say that US gasoline consumption peaked in 2018/2019. Consumption in May 2024 was 8831 thousand barrels, a 6% decrease since May 2019.

This is remarkably close for all the months 2024 before May (Jan-April) vs their respective peaks in 2018 and 2019.

Technological Impact on Gasoline Demand

This is very impressive considering according to Statista the US registered cars increased from 276 MM in 2019 to 283MM in 2022 or roughly 1% annually. It will be fair to extrapolate that while US registered vehicles are up 4%-5% since 2019, US gasoline consumption is down 6%. I think not all the drop in demand comes from purely electric cars.

Some are due to the improved technology of combustible engines and the increased popularity of hybrids, but the drop in gasoline demand is actual.

Here is a look at electric vehicle sales in the US as a percentage of new car sales, according to caredge.com.

| Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | |

| Battery Electric Vehicles (BEV) | 5.3% | 5.6% | 6.1% | 6.5% | 7.3% | 7.2% | 7.9% | 8.1% | 7.3% |

| Electrified (Hybrid+PHEV+BEV) |

12.4% | 12.6% | 12.1% | 13.0% | 14.5% | 16.0% | 17.7% | 16.0% | TBD |

Yes, there is a slowdown in growth of electric vehicles but again slowdown in the growth. The secular trend towards more energy efficient vehicles is unchanged and it is just a matter of time to see further decrease in future gasoline consumption.

The data so far purely looks at the US, however, it can be assumed to be similar for most Western European countries and even more potent in China. According to official data nearly 25% of new car sales in China in 2023 were electric vehicles and China is the biggest auto market in the world with nearly 30MM new cars sold in 2023, while the US is distant second with 15.5MM new cars.

Long-Term Implications for WTI Crude Oil Prices

That being said, while the long-term implications for oil continue to be bearish, it is notable that the expected rate of BEV (battery electric vehicle) adoption has decreased. While the WTI oil curve continues to be inverted, it is not as inverted as before.

Most notable according to State Street Global Advisors, analysts covering oil stocks expect the constituents of XLE (S&P500 Energy Sector) ETF to grow on average 6.7% over the course of next 3-5 years.

This is quite the reversal, as expectations were negative at the beginning of the year.

Key Takeaways

In conclusion, we are going to say that it seems, at least to us, that one day, gasoline and diesel vehicles will go extinct in favor of BEVs. However, that future may not be so soon. We continue to be uncomfortable investing in the sector as it is akin to selling life insurance to terminally ill patients.

Nevertheless, the patients are showing some signs of improvement. Some stocks in the sector may be significantly undervalued, offering an opportunity to make money. Still, we will not overweigh the sector in any of our portfolios.

We can summarize: we are still cautious but not as careful as in September 2023.

Get the trading edge you need in today’s markets – sign up for our monthly newsletter featuring in-depth expert analysis, hot market insights, and exclusive trading strategies.