Platinum vs Gold: Is Now the Right Time to Invest in Platinum

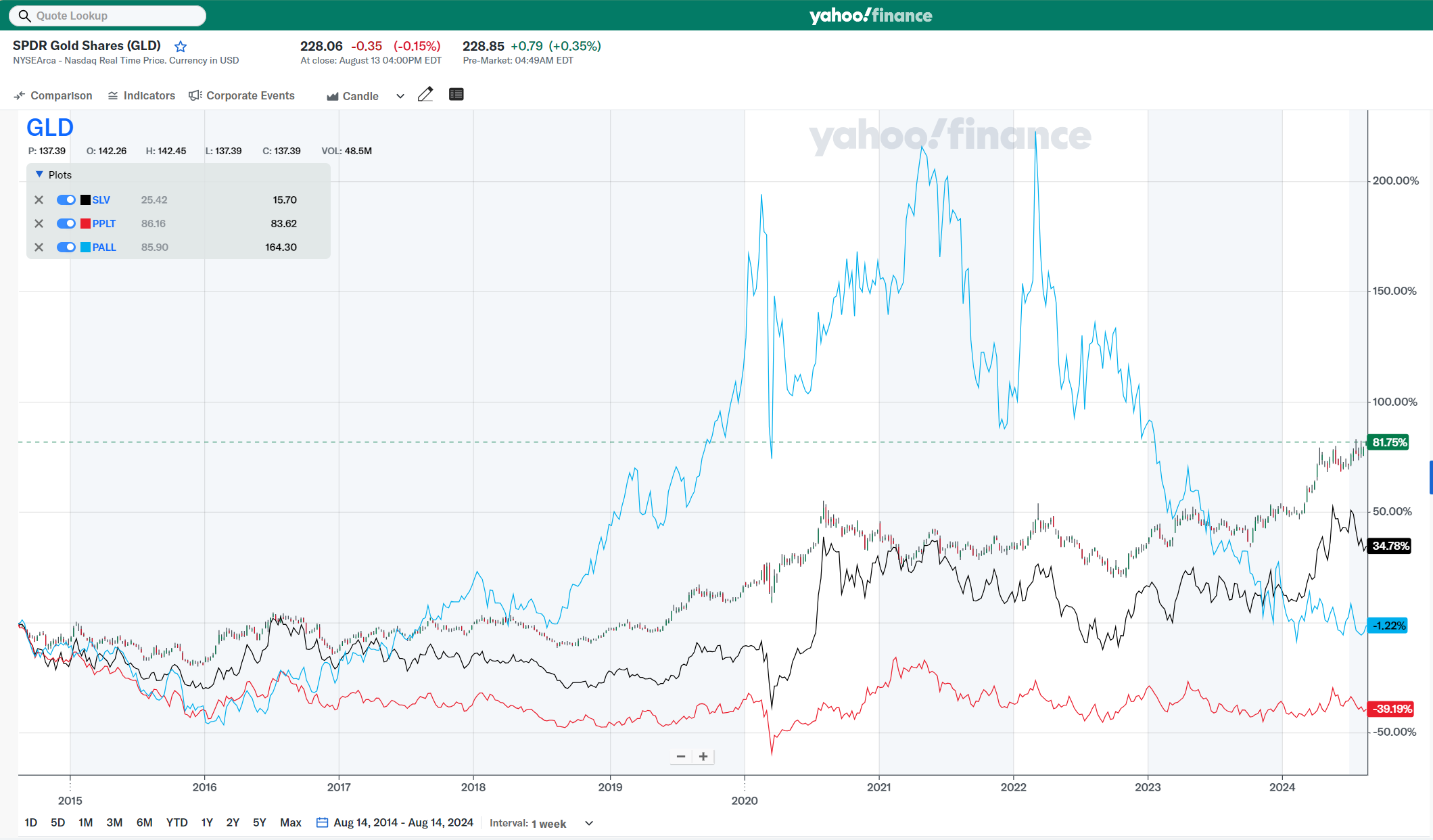

In our earlier discussion on gold alternatives, we spotlighted platinum as a potential investment choice. In light of growing reader interest, we’re diving deeper into comparing platinum vs gold. While gold has seen substantial gains over the past decade, platinum has faced a significant decline, diverging from its historical correlation with gold. This prompts a reassessment of platinum’s investment potential.

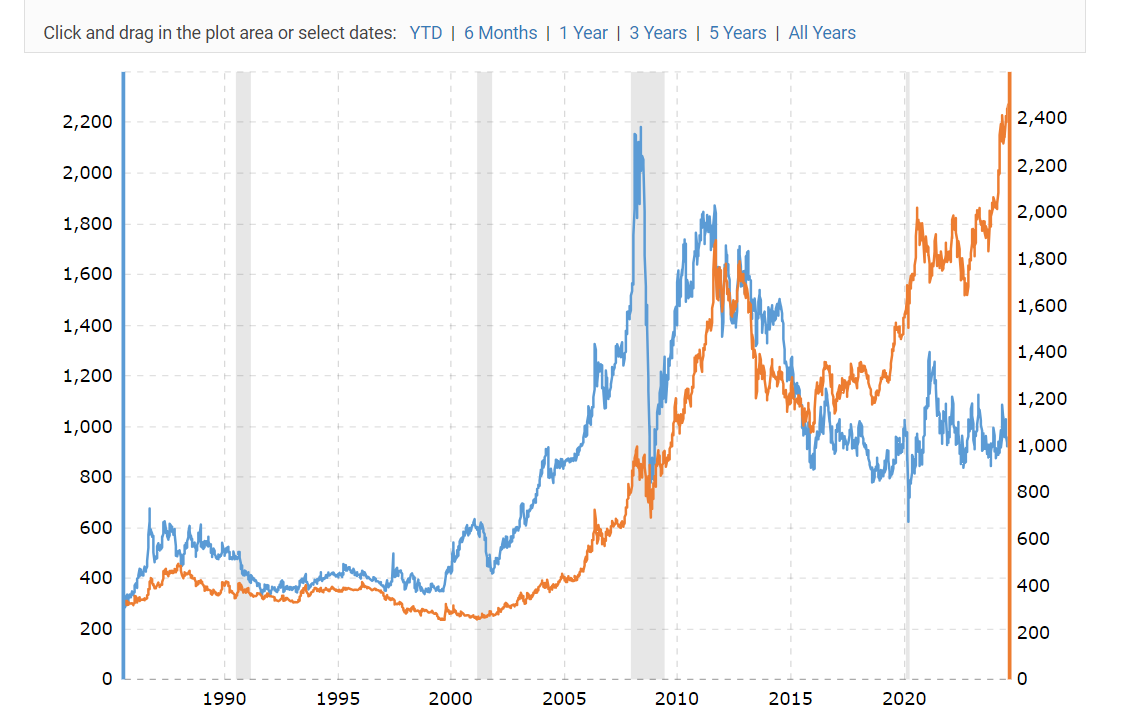

The Key Graph: Gold vs Platinum Returns

This even goes against the common sense that inflation, in the long run, should increase the prices of all assets. That has been true for practically all assets—except platinum. It is not just down a bit like palladium, -1.22% for the 10 years; platinum has been cheaper by nearly 40% since 2014.

This may be a good time for a little bit of mental education. Gold, silver, platinum, and palladium are the most commonly known and traded precious metals. According to Wikipedia, there are 16 precious metals. All of them trade, but aside from the first four, most others are illiquid and only traded OTC. An active futures market for metals and physical ETFs holding the metal makes gold, silver, platinum, and palladium more interesting.

Historical Price Correlation

Let’s look at platinum vs gold over the long run – 40-year price history (courtesy of Macrotrends):

As you can see for yourself, the historical correlation is very high. Usually, platinum has been more expensive than gold—sometimes a lot more expensive—up until 2016-2017, when the price of gold started to rise, and platinum never followed. Why would that be?

This is actually a very difficult question to answer, and to begin answering it, we need to do another set of metals education. First, data for precious metals is incredibly difficult to find. Countries use statistics differently, and sometimes, those statistics may not be entirely trustworthy.

Moreover, when data is aggregated, errors, omissions, double counting, and educated guesses could occur. It’s just part of life in the precious metals markets. Let’s start with one source we have learned to trust – Wikipedia.

More precisely, global production of the above-mentioned precious metals for 2023.

| Metal | 2023 Production in Tons |

Price per Ounce |

Price per Ton |

Mining Revenue at Exchange Price |

| Gold | 3000 | $2,472 | $87,226,535 | $261,679,604,799 |

| Silver | 25000 | $28 | $988,003 | $24,700,070,572 |

| Platinum | 180 | $940 | $33,168,666 | $5,970,359,915 |

| Palladium | 210 | $930 | $32,815,808 | $6,891,319,689 |

Production and Revenue Comparison

The important thing to note from the table above is that price per ton is derived from the price per ounce for the exchange standardized purity of each metal. That purity is usually very high, relative to the most mined metals, so the revenue projected for each mining industry will be lower than what the table suggests.

However, it is a good approximation, especially relative size of each metal market. We can clearly see that Gold is the king of precious metals when it comes to revenues.

Yes, silver is the most commonly mined precious metal but revenues from silver mining are nearly 10 less than those of gold miners. Platinum miners in general produce 15 times less output than gold miners in terms of tonnage and their revenues are overall 40 times smaller.

Market Realities: Key Points in the Platinum vs Gold Debate

Platinum’s market is small and highly susceptible to price swings, whether upward or downward. Consider this: 60% of the world’s platinum is sourced from a single country—South Africa—a region with a mining industry that has struggled with safety issues.

Additionally, the estimated production cost for platinum is around $700-800 per ounce. Increasing production would push costs even higher, to about $1,100-1,200 per ounce. These are crucial factors to keep in mind, but there’s one more critical point you should know.

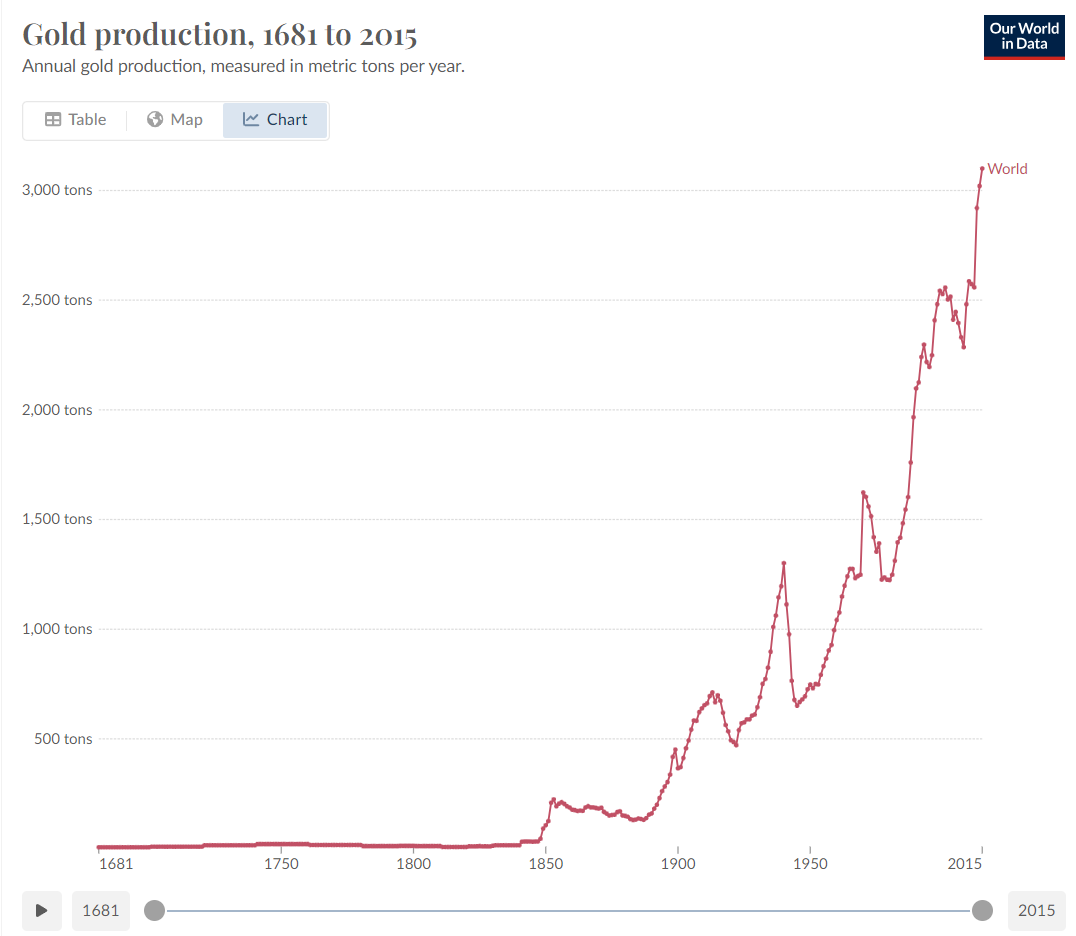

Here’s a chart from Our World in Data showing 200 years of gold production:

While data about precious metals is difficult to find and confirm, it is an overwhelming fact that as the world’s population and wealth have been increasing, so has metal production. While it may seem like a long time for some people, 8-10 years is a relatively short time frame from a historical perspective.

Key Takeaway

Gold and platinum have had very strong relationship for centuries, it is only over the last 7-8 years that this relationship has weakened. The cost of mining metals did not decrease during that time. It is only a matter of time before the world decides to use more platinum – it is a demographic projection.

Still, those projections are almost guaranteed to occur: in the next 25 year the world’s population will increase by 25% from 8 Bln people to 10 Bln people.

As we said, this is a demographic projection, but looking at history, those demographic projections tend to turn true consistently. The platinum prices offer an incredible opportunity for investors with horizons longer than a few years.

We believe current prices are below the average cost of production. The reason producers are still able to produce and stay profitable is that they are delaying maintenance and repairs. Maintenance and repair can be delayed but not avoided. Historically high correlation between platinum and gold is likely to return, which means potentially 100%-150% return for the holders of platinum.