Is BABA Stock a Smart Buy or a Pass

Alibaba Groups’ Value Through the Lens of Our 7-Step Valuation Method

Trading and investing are rarely black and white; they’re a blend of art and science. This holds true for any stock; BABA stock is a perfect example. Many new investors enter the market hoping to find the “Holy Grail”—a strategy that will guarantee success every time. But in reality, no strategy is flawless when applied flexibly in real-world situations. Even the best approaches need regular fine-tuning, and traders must be willing to adjust and compromise along the way.

Like any major investment, clear rules are essential to guide decision-making for Alibaba Group stock. However, these rules can’t be rigid; they often need to shift with the market. While setting these rules involves careful analysis, the true challenge lies in applying them flexibly in real-world situations.

This article will look at BABA stock using our 7-step valuation system, illustrating how a thoughtful combination of structured analysis and flexibility can enhance your investment strategy.

Step 1: Focus on Large Companies

According to Wikipedia, Alibaba Group (BABA) is a Chinese multinational technology company specializing in e-commerce, retail, the Internet, and technology. BABA’s market capitalization is 240 billion USD, which makes it one of the top 50 companies in the world by market size.

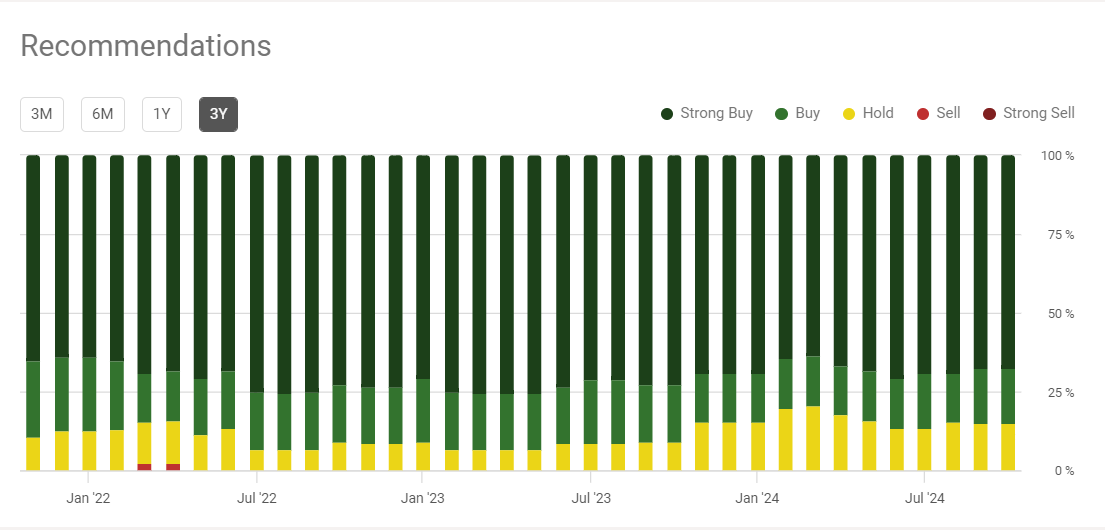

Step 2: Examine Analyst Recommendation for BABA Stock

A fundamental principle in our valuation method is to assess analyst recommendations. For BABA stock, an impressive 85% of analysts (39 out of 46) currently rate it as a Buy or Strong Buy. Historically, that ratio has been around 85% and never under 80%. There have been very few Sell recommendations, only for two months in 2022. Clearly, stock analysts love the company.

Step 3: Analyze Price Targets for BABA Stock

The lowest analyst price target should not be much lower than the current stock price. Additionally, the average price target should be at least 20% higher.

BABA’s current stock price is 100. The lowest price target is 86.05, while the average is 119.74.

Here, we need to adapt our rules. Since many analysts have recommended BABA stock as a Buy, we can overlook the lowest target. This figure might be an outlier. Instead, we will focus on the average target.

However, we must be cautious. While it is important to follow the rules, we should not do so blindly.

Step 4: Compare Forward P/E Ratios to Relevant Indices

We believe that in the case of BABA, the relevant index should be MSCI Emerging Markets Index (EEM ETF):

| 2024 P/E | 2025 Forward P/E | 2026 Forward P/E | 2027 Forward P/E | |

| BABA Stock | 11,42 | 10,19 | 9,29 | N/A |

| MSCI Emerging Market Index | 16,78 | 15,25 | 13,87 | 12,60 |

BABA’s earnings estimates are only going out until the end of 2026. This is not the best-case scenario, but we consider it substantially undervalued, given how cheap BABA is relative to its benchmark.

Step 5: Insider and Institutional Ownership of BABA Stock

The soft hurdle we have for step 5 at present is 70%. BABA’s insider and institutional ownership rate is an abysmal 14.98%. That alone is usually enough for us to abandon the idea. However, BABA is a top-50 world company that is loved by stock analysts and is exceptionally cheap compared to its benchmark.

The low institutional ownership rate reflects the attitude of avoiding Chinese stocks in general, but BABA is not just an average Chinese stock. It is one of the best Chinese stocks.

Additionally, BABA is very shareholder-friendly; since 2021, the company has repurchased 12% of its outstanding shares. Therefore, we will not abandon our long idea of doing a smaller size.

Step 6: Monitor Short Float Levels

The table above shows that the short float is 2.84%—above our soft hurdle of 2%. Some humans have decided not only not to buy but to short the stock, considering BABA’s valuation. This is a concern, but we will proceed for the reasons we put forth in Step 5.

Moreover, the data is dated – it reflects the short position in the stock as of September 30th, 2024, when it was trading nearly 20% higher—invariably another caution on size – not going to bet the house on BABA going up.

Step 7: Validate Alibaba’s Business Model

BABA is one of the largest publicly traded Chinese companies. It is a conglomerate with multiple business lines, and having been listed for 10 years on the NYSE, we would give BABA stock a pass on this step.