Lowering Interest Rates: What to Expect

How Falling Interest Rates Affect the Economy and Your Investment Strategies

As central banks worldwide begin lowering interest rates, many clients and colleagues have asked us what this shift could mean for the economy and their investments. In response, we’ve compiled answers to the most frequently asked questions to provide insight into historical trends and future expectations.

Q: What does history tell us about the cycle of lowering interest rates?

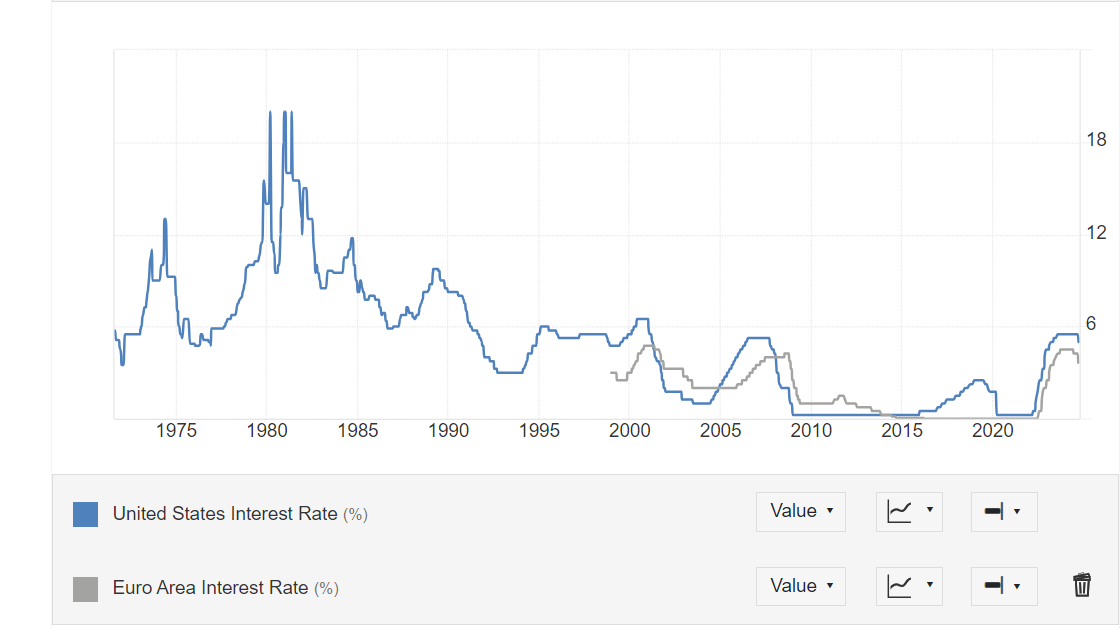

A: Below, you will find a 50-year chart of interest rate levels in USD and EUR:

We would separate the chart into two parts – before 2000 and after 2000. The difference is not just the new Millennium but rather the change in policies of most Central Banks. Before 2000, Central Banks were not mindful of the markets that much.

Starting with Mr. Greenspan and especially after Mr. Bernanke, central bankers began exercising a lot more caution in their actions, and thus, there is greater predictability in interest rates.

Before 2000, interest rates worldwide fluctuated quite a bit; some would even use the word violently. However, since 2000, we have seen an apparent cyclicality in interest rates. Once interest rates start rising – they keep on rising.

Once interest rates start falling – they keep on falling. We, and most analysts, think that history will repeat itself, and the Fed and the ECB will keep lowering rates for the remainder of 2024 and 2025.

Q: How far will lowering interest rates go?

A: An old market adage says, ‘Small crops get smaller, big crops get bigger,’ meaning that market expectations are often conservative at the beginning of a cycle. When rates began rising in 2022, few predicted how high they would go. Similarly, current expectations for falling rates might be modest, suggesting that rates could drop further than anticipated.

When the cycle of interest rate raises started in 2022, very few people predicted that interest rates would increase as much as they did. Currently, markets expect USD interest rates to be at 3% at the end of 2025, while those in EUR are expected to be at 1.75% for the same period. History suggests that those expectations might be modest – rates might go even lower, but let’s go with those expectations for now.

Q: Usually, when bonds go up, stock markets go down. Do you expect a recession?

A: We do not. Historically, some of the strongest market performances occurred during periods of falling interest rates, such as in the 1980s. We anticipate a similar pattern in the coming years, where declining rates will support economic growth and market gains.

Q: What are you doing for clients right now?

A: While stock markets have indeed scored some very impressive gains in 2023 and 2024, expected future returns have not gone down. We still expect the US stock market to average around 10% annual returns for the next 2-3 years. For long-term investors, a balanced 60/40 allocation—60% equities and 40% bonds—remains a prudent strategy, particularly for those with an investment horizon exceeding 10 years.

Romanian government bonds are a suitable option for investors with shorter time horizons or a lower risk tolerance. As an investment-grade issuer (BBB—), Romania offers 5-year bonds with competitive rates of 4.2% in EUR and 5.2% in USD.

In summary, falling interest rates can lead to favorable market conditions. By adopting a balanced investment strategy, investors can find growth opportunities, whether they are focused on long-term gains or lower-risk options