Why You Need to Buy (US) Stocks in One Chart

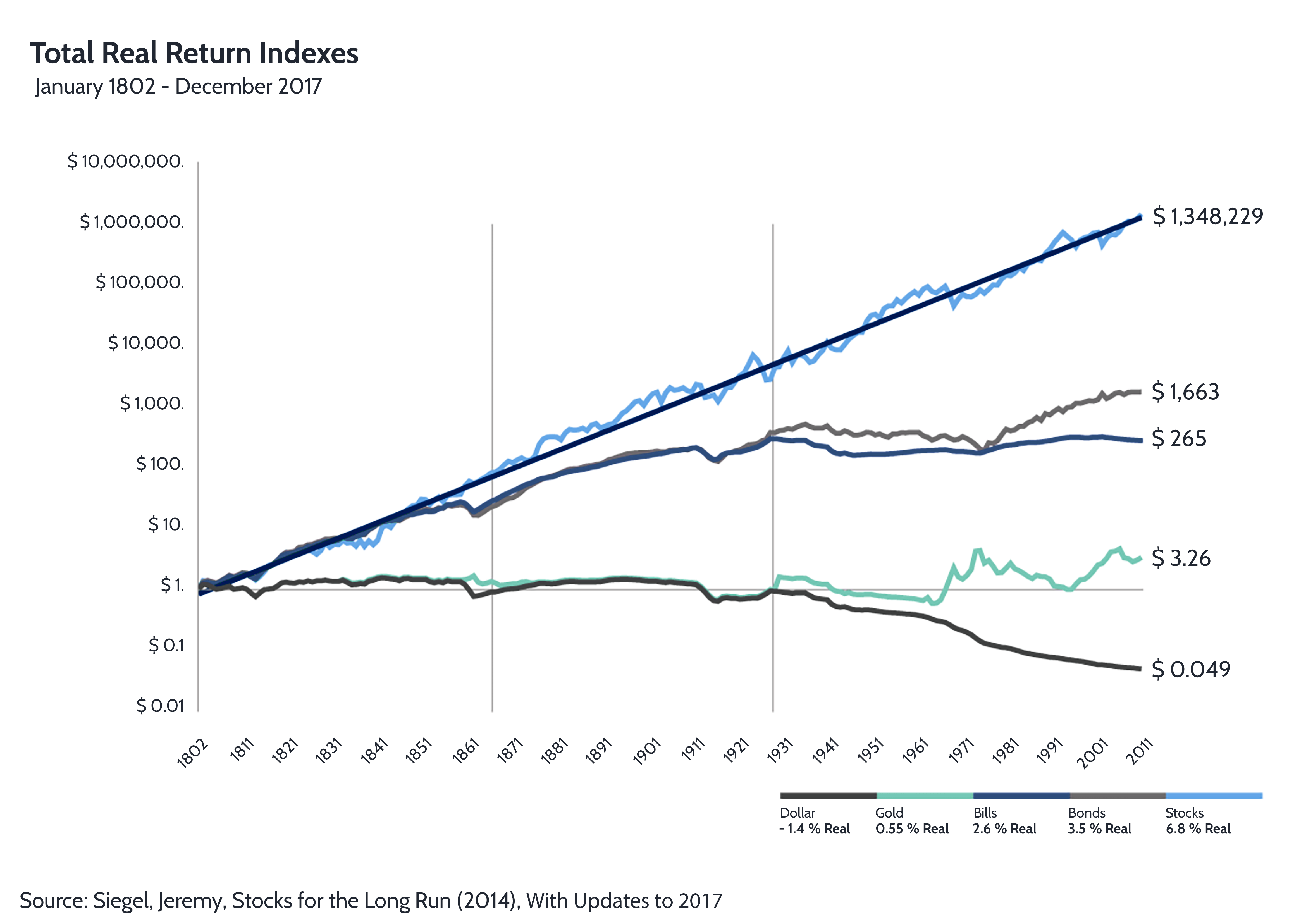

Prof Jeremy Siegel of the Wharton School published a chart in his book Stocks for the Long Run that we want to share with you:

We decided it would be better NOT to update the chart to the present time, since we need to know his exact calculation for inflation and, thus, actual returns. Even if we did, the graph would NOT be substantially different!

Allow us to put our interpretation of it:

US Stock Investments (Dow Jones):

A true perpetuum mobile! It yields a constant real return of 6.8% (above inflation)! A primary reason why people are not invested in US stocks is ‘because something might happen.’ We want to borrow the advice from Charlie Munger to address this concern – ‘When you find a long-term pattern, look for reasons why it would continue, rather than abruptly stop.’

Publicly listed US companies are some of the world’s biggest, best-run, and most profitable corporations. Moreover, professional management, a substantial public float, and a functioning judicial system have resulted in positive returns for all domestic and foreign shareholders! The US stock market and the Dow Jones, in particular, have delivered returns well above inflation for over two centuries.

US Government Bond Investments:

Mr. Siegel argued that US government bond investments are inferior to stocks and thus should NOT be a significant part of any portfolio. However, over the long run they are still positive expectancies, and we can purchase US high-yield corporate bonds instead of government bonds. That was certainly the case in 2011 when the chart was published.

Gold Investments:

I am sorry, but you are a fool!

Yes, gold is an asset that has been used for thousands of years as a store of value. However, it has also been a non-income-producing asset. Expecting it to make above-inflation returns is, well, quite optimistic!

Moreover, gold as a metal is not that rare. Yes, it is rare on the surface of the Earth, but in the deeper levels of the Earth’s crust, it is relatively abundant! Historically, significant gold deposit discoveries like The California Gold Rush happen every 20-40 years, and we last had an important gold deposit discovery several decades now. How would you feel as a gold investor if, tomorrow, somewhere in Africa or South America (two significantly underexplored but promising regions) suddenly, a farmer stumbled across a large gold deposit? What would happen to the price of gold if that discovery was easy to bring to production?

Gold is NOT a good industrial metal. It needs to be softer, and while there are industrial applications for gold, its price relative to other metals makes it quite impractical and expensive. The only other meaningful application for gold aside from a store of value is in the jewelry industry. For thousands of years, for some reason people have found the glitter of gold irresistible! However, that glitter is unlikely to transform into significant above-inflation returns in the future.

Holding Cash:

Write 1000 times — ‘I Will Not Fight the Fed.’

Inflation has been a fact of life for most global economies for nearly a century. While financial crises like 2008 and what happened in 2020 can occur, they are rare. In the long run, returns and stocks are the best hedges against inflation once they pass inflation. Corporations own assets and DO have pricing power. Thus, even if inflation remains persistently high, it is doubtful that corporations will likely produce returns above inflation for their shareholders.

Crypto Investments: (Not pictured)

We constantly hear about how digital assets are the future but are they? Could they be the future that never arrives?

Digital assets and blockchain technology are NOT that new. They are almost 15 years old now. Have they changed your life in any significant way or the life of others around you? We remember when the internet arrived — within a decade, everybody was using it. Whose life has Bitcoin changed — invariably drug dealers, money launderers, and phish scammers. Are you one of them?

Moreover, similar to gold, digital assets are not income-producing assets. Yes, there are quite a few players like FTX that promised and still promise to give you interest on those assets, but well, those are just promises… Could you wake up one day, and find your access to those assets gone? Regulations or the lack of ANY regulations in the asset class should be, at the very least, very troubling.

Returning to history, only one non-income-producing asset class has had returns above inflation: art! There are similarities between Bitcoin and art — both are in limited supply! So, if you are a crypto investor, and especially a Bitcoin investor, unwittingly you might be an art collector as well.

Sources:

Disclaimer: