Opinion: Amazon vs. Apple — Which Should You Own if You Can Only Own One?

Both Big Tech companies are on the move, but in a comparison of stock-market returns, products and profits, one has an edge

Investors have been increasingly reliant on Big Tech stocks in recent years. But not every tech company is created equal.

The two biggest technology companies — Apple Inc. AAPL and Amazon.com AMZN — are different in many ways, yet are sometimes mentioned in the same sentence simply because of their dominance and size.

In August, Apple became the first company in history whose market capitalization topped $1 trillion. Amazon followed soon after in early September, though has since fallen a bit.

Many investors are eager to own both of those companies. But should they?

Here’s a look at both of these trillion-dollar tech names, and which one is better. After all, you might not want both mega-caps to dominate your portfolio.

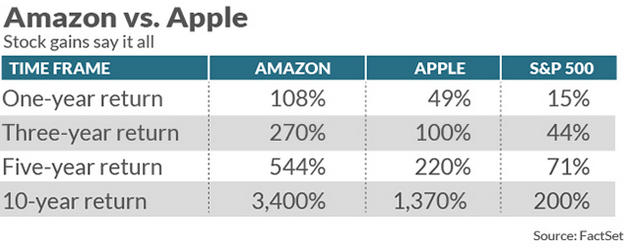

Share momentum — winner: Amazon

Apple and Amazon shares have been undeniable winners, blowing away the broader returns of the S&P 500 SPX across many time periods. But Amazon’s steep ascent has outperformed Apple in a big way. Just look at these returns over various time periods:

Price targets — winner: Amazon

Forget about the past, though; what does the “smart money” expect from both of these names in the future? Well, Stifel and Jeffries just put the same target of $2,525 on Amazon at the end of September for roughly 20% upside after its already impressive run of more than 60% this year.

Apple forecasts are more subdued, with some of the more recent calls including Nomura’s and J.P. Morgan’s $215 targets — slightly below current levels. This is not to say investors are expecting a crash in Apple’s stock, but the disparity is telling.

Current valuation — winner: Apple

With a forward price-to-earnings (P/E) ratio that’s less than 17, Apple is actually trading for less of a premium on future profits than the typical stock; the S&P 500 has an average forward P/E of about 18 at present, and the tech-heavy Nasdaq 100 NDX boasts an average P/E of almost 22.

Amazon has long focused on growth over profit, and trades for almost 80 times forward earnings. It’s also worth noting that Apple’s nearly $1.1 trillion in market value is built in large part on roughly $250 billion in cash and investments — a big backstop for investors.

Recent product launches — winner: Apple

Both Apple and Amazon made big splashes lately with new product launches — Apple, with a new suite of smartphones and an update to its smart watch, and Amazon with a new line of its Echo voice-assistant devices and an upgrade to its Fire TV streaming offerings.

However, while it’s undeniably important for Amazon to keep innovating and pushing the envelope in the consumer-tech areas where it’s increasingly a player, nobody does hardware like Apple. Industry estimates currently predict 85 million units sold by year-end, with all of its newest smartphones carrying a four-figure price tag. Amazon is still very much experimenting and courting curious customers with its launches, while Apple is making material profits.

Earnings results — winner: Apple

Apple blew the doors off its second-quarter earnings report in July, beating the top and bottom lines and guiding above Wall Street’s expectations on revenue. The report was powerful, considering the relatively weak iPhone sales in advance of a refreshed product line, and hints at continued momentum for sales and profits in the coming quarters. The shares added about 10% across the next few trading days after that July report.

Amazon’s report also offered a lot to cheer about. The company posted its biggest-ever quarterly profit, thanks to less spending, trumping Wall Street expectations. However, revenue did slightly miss the mark, and it’s worth noting that the big bump in profitability may not be a long-term trend because of its reliance on less spending for efforts such as hiring.

Both had good news in the second quarter, but Apple’s is more encouraging going into third-quarter earnings in a few weeks.

Executive leadership — dead heat

It’s incredibly difficult to compare Apple CEO Tim Cook with Amazon CEO Jeff Bezos. There are reasons to like both execs and their admittedly different resumes, with one a creative force and the other an operations expert, but it’s impossible to definitively say one is “better.”

The 54-year-old Bezos was in on the ground floor at Amazon and has been a tech icon for over two decades. He has the typical brash management style we have come to expect from Silicon Valley execs of his generation. Bezos may be a bit closed-mouthed about Amazon operations and a bit less concerned with the bottom line, but you can’t deny the success of his hard-charging approach at new tech frontiers.

Apple’s Cook, on the other hand, wasn’t a company founder or a product guru. Instead, he was an operations guy at PC shop Compaq whom Steve Jobs hired in the late 1990s to bring discipline to Apple. Cook, 57 years old, played an integral role in streamlining manufacturing and distribution during the company’s troubled years, and his expertise has allowed Apple to thrive at its amazing scale to this day.

Verdict — winner: Apple

I’m certainly not betting against Amazon. The e-commerce king has a lot going for it, and continues to stay innovative. However, Apple has a ton more cash (and a dividend for shareholders) and seems to be on an upswing with its new product launches and loyal installed user base.

Amazon is undeniably dynamic, but on Wall Street that frequently means moves in both directions. Maybe I’m chicken, but I’ll take the reliability of Apple’s balance sheet over the volatility, but big potential, offered by Amazon.

Article and media were originally published by Jeff Reeves at marketwatch.com