How to Pick Bonds the Smart Way

Minimizing volatility is the margin of safety, while maximizing Z-score is the edge

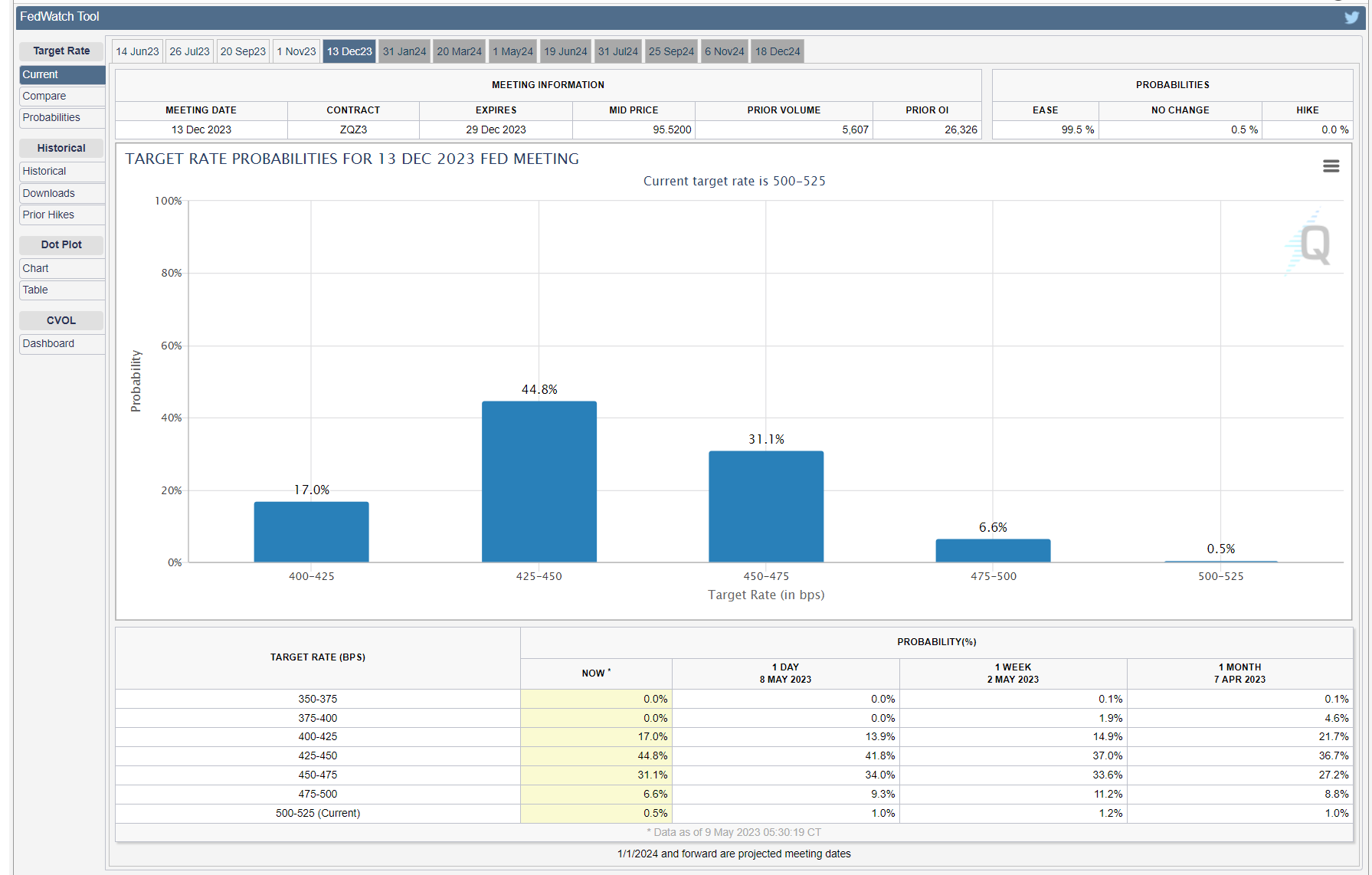

If you follow the financial markets, you probably already know that last week the Federal Reserve raised rates again by 25 bps to 5.25%. The 5.25% is a level last seen in 2006, and if rates are to be raised any further short-term interest rates will be “breaking” new 20-year highs. Fortunately, markets are predicting that this will not happen. Moreover, they are not only expecting that rates will not be raised but starting in September 2023, the Fed will gradually start LOWERING rates.

As you can see from the CME’s Fed Watch Tool website below, by the end of 2023 (13 Dec 2023), markets expect the Fed Funds rate to be between 4.25%-4.50% or 75 bps LOWER than the one at present. Check the chart below for a reference.

We will not speculate if those market expectations are correct; we will explore what to do IF markets are roughly CORRECT about what the Fed will do. When the Federal Reserve considers lowering rates, it prompts the question of how to pick the right bonds to invest in and the rationale behind those choices.

In our analysis, we will look ONLY at US government bonds. Not because those are the only bonds one can and should buy but because the data for US debt is easy to collect and essentially free of errors:

| 2 YR Yields | 5 YR Yields | 7 YR Yields | 10 YR Yields | 30 YR Yields | |

| Average | 1.15% | 1.70% | 2.06% | 2.34% | 3.10% |

| Min | 0.11% | 0.22% | 0.39% | 0.54% | 1.20% |

| Max | 4.20% | 3.64% | 3.59% | 3.61% | 4.57% |

| St Dev | 1.10% | 0.83% | 0.77% | 0.78% | 0.85% |

| Z-Score | 2.43 | 1.91 | 1.71 | 1.29 | 0.73 |

In our research, we looked at US government bonds since 2009. Why since 2009, one may ask – the answer is that the Federal Reserve started behaving a lot more aggressively since the Global Financial Crisis of 2008. Before 2008 the Fed would lower or raise interest rates, but since 2008 the Fed actively participates in the government bonds market, influencing not only short-term rates but also long-term ones.

Let’s look at the 2YR Yields for example. From Jan 2009 to the present, two-year US government bond yields have been between 0,11% and 4.20%. The average has been 1.15%, with a standard deviation of 1.10%. In this case, the present level of interest rates (May 2023 – 3.82%) has a Z-score of = (current level – average level)/standard deviation = (3.82%-1.15%)/1.10% = 2.43.

Standard deviation & Z-score level

The Z-score level measures how far away from the current long-term average the market is – for 2-year government bond yields, it is 2.43 standard deviations away from its average levels. Which is actually a pretty large extreme. We can see that Z-score is relatively high for ALL parts of the yield curve but mainly for the SHORTER durations – looking at the 30-year yields, the present level is NOT that attractive – a Z-score of 0.73 for the 30-year government bonds!

The other interesting observation is that interest rates are MORE volatile in short and at the long end of the curve and LEAST volatile in the 7-year and 10-year yields. Given that the Z-score for 7-year results is MUCH HIGHER than 10-year yields and the standard deviation is the LOWEST – this is our favorite part of the curve.

Key takeaway

In conclusion, position sizing and choice of investments make the difference between a losing and a winning investor in the long run. Determining what to buy and how much is usually based on the concepts of margin of safety and edge. In this case, we see that edge (Z-score) is highest in the short-term (2-year yields, but the standard deviation is lowest for the 7-year yields. We have chosen to MINIMIZE volatility first (margin of safety) and then maximize the Z-score (edge) second.

The important thing here is that this is an ideal scenario or even a starting point only – in practice, we will look at individual bonds across 5-10 year maturity horizons, and many factors will come into play like average bid-ask spread, yield to maturity on the ask, after-tax yield (if applicable), issue size (as a proxy for future liquidity).

However, even when we look at all issues, we will keep in mind that we are looking ideally at a 7-year bond. Certainly nothing longer than ten years as the Z-score peaks at 5-year bonds and is MUCH WORSE (30% lower) for 10-year government bonds.

Sources:

Disclaimer: