Eastern European Government Bonds: Interest Rates Overview

We’ve been closely monitoring Eastern European government bonds’ interest rates. As explored in previous editions of Market Insights, the fixed-income environment was poised to rebound from its exceptionally oversold state, presenting an opportune moment for investors. Our predictions have become pretty accurate, and we have stayed positive for this asset throughout the year.

Now, we will take another look at government bonds in Eastern Europe. We’ll explore the details of this asset class by regularly observing and studying it. Our journey began in October 2022 with Are Eastern European Bonds Way Too Undervalued, followed by Eastern European Bonds as A Good Bargain (February 2023) and Do Eastern European Bonds Still Offer Opportunities (July 2023).

Market Expectations and European Central Bank Insights

But before we start looking at the sector’s performance, let’s take a look at what the markets expect from the European Central Bank. Here are current expectations:

| Date | 3M Euribor Futures | Change vs. Jan 2024 |

| Jan 2024 | 3,92% | |

| Mar 2024 | 3,70% | -0,22% |

| Jun 2024 | 3,25% | -0,67% |

| Sep 2024 | 2,82% | -1,10% |

| Dec 2024 | 2,44% | -1,48% |

| Mar 2025 | 2,24% | -1,68% |

| Jun 2025 | 2,14% | -1,78% |

| Sep 2025 | 2,12% | -1,80% |

| Dec 2025 | 2,09% | -1,83% |

It is important to highlight what 3M Euribor Futures mean. In this case, markets expect 3M Euribor in March 2024 to be 3,70% or 0,22% lower than the present level of 3,92% in January 2024. So, the above instruments (3M Euribor Futures) indicate what 3 months Euribor will be on a specific date.

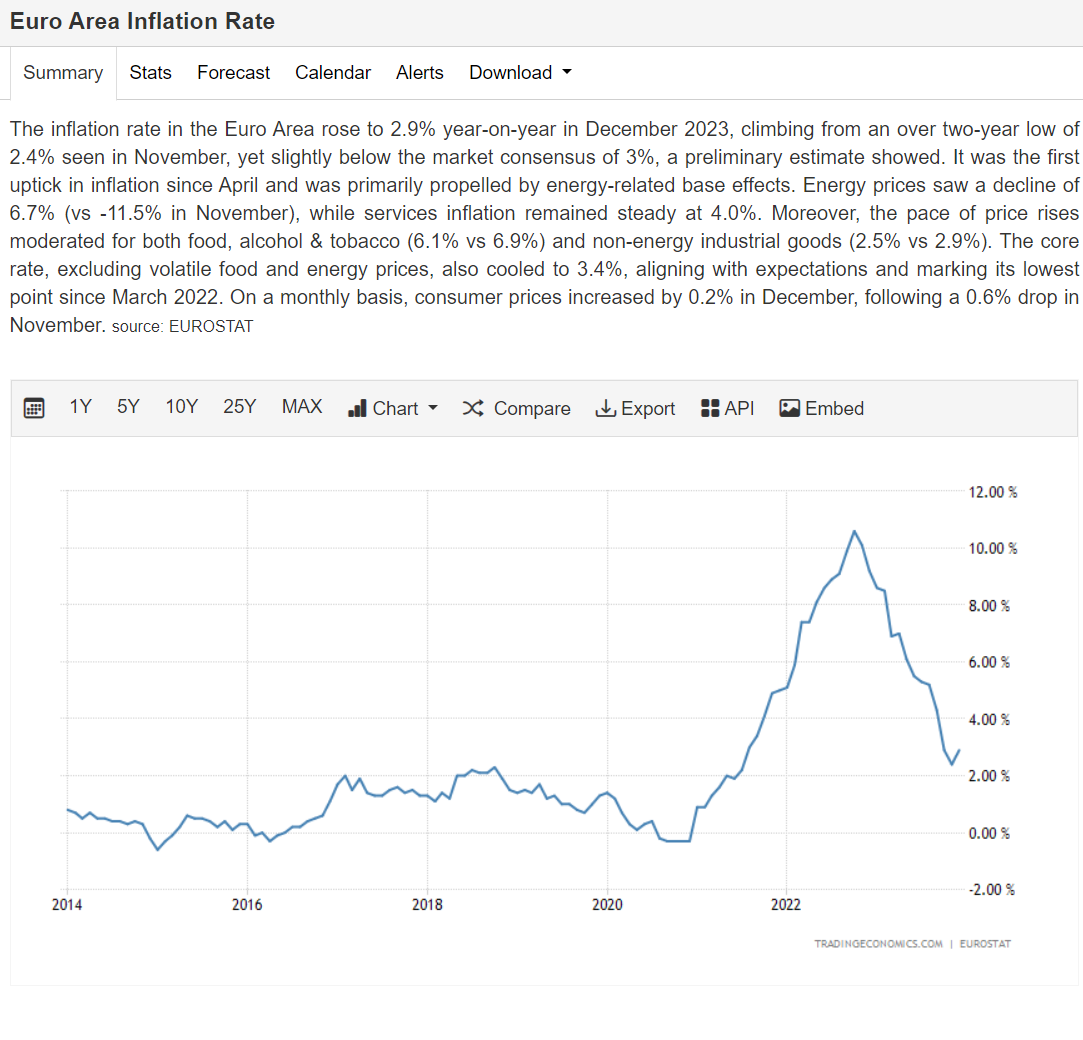

Data shows that markets are pricing a reduction of nearly 1,5% in 2024 and an additional 0,75% in 2025. Those expectations are based on the facts the inflation in the Euro Area, measured by Euro Area CPI, has dropped to 2,9% Y/Y as of December 2023:

Yes, inflation in the Euro Area seems to be contained, and markets are already pricing quite dramatic cuts of nearly 1,75% to around 2,1% in the next two years. In other words, markets are pricing the pretty dovish outlook for bonds for the foreseeable future.

Yes, inflation in the Euro Area seems to be contained, and markets are already pricing quite dramatic cuts of nearly 1,75% to around 2,1% in the next two years. In other words, markets are pricing the pretty dovish outlook for bonds for the foreseeable future.

Let’s start with the top recommendation from our previous articles – Romania 2.875% 2028:

Since our first publication a little over a year ago, the bond is up 13.34 points (from a clean price of 80 to 93.34) and has received an accrued coupon of 3.36%. So, the total return for the period was 16.70 points when the clean price was 80.

That would give us a return of over 20% for slightly longer than a year! Not bad for a dull, safe government bond!

Since our first revisit on February 2023, the bond is up 6 points (from the clean price of 87,33 to 93,34) and has paid interest of nearly 2,65 for a total return of 8.65 points on invested capital of 87.33 or almost 10% return for 11 months.

Since our second revisit in July 2023, the bond is up 3.6 points (from clean price 89,75 to 93,34) and accrued coupon of 1.45 points for a total return of 5.05 points on invested capital of 89.75 or 5,6% return for a 6-month holding period.

Here are the returns on another one of our recommendations – Bulgaria 3% 2028. Total return since

- November 2022: 11% for 14 months / 9.4% annualized

- February 2023: 7% for 11 months / 7,6% annualized

- July 2023: 3,5% for 6 months / 7% annualized

Finally, we are going to our last recommendation of Hungary 0,125% 2028: total return since 7/2023: 5% in 6 months/ 10% annualized.

Government Bonds: Interest Rates

But those have been our recommendations. Let’s take at the performance of various bonds in the region, comparing AAA, BB, and BBB-rated bonds in Germany, Greece, Bulgaria, Romania, and Hungary for a period of 14 months:

| Date | AAA | BB | BBB | BBB- | BBB |

| Germany 5 Yr | Greece 5 Yr | Bulgaria 5 Yr | Romania 5 Yr | Hungary 5 Yr | |

| Dec-21 | -0.45% | 0.71% | 0.38% | 1.63% | 0.18% |

| Jan-22 | -0.27% | 0.96% | 0.52% | 1.99% | 0.42% |

| Feb-22 | -0.13% | 1.62% | 0.97% | 3.20% | 1.47% |

| Mar-22 | 0.37% | 1.50% | 1.28% | 3.23% | 2.22% |

| Apr-22 | 0.68% | 2.35% | 2.17% | 4% | 3.06% |

| May-22 | 0.84% | 2.35% | 2.55% | 4.46% | 3.90% |

| Jun-22 | 1.10% | 3.06% | 3.57% | 5.87% | 3.94% |

| Jul-22 | 0.53% | 2.39% | 2.97% | 5.18% | 3.34% |

| Aug-22 | 1.38% | 3.46% | 2.92% | 5.78% | 3.14% |

| Sep-22 | 1.96% | 4.33% | 4.71% | 7.65% | 5.15% |

| Oct-22 | 2.01% | 4.31% | 4.88% | 7.13% | 5.24% |

| Nov-22 | 1.95% | 3.42% | 3.81% | 5.82% | 4.30% |

| Dec-22 | 2.57% | 3.88% | 4.12% | 5.76% | 4.85% |

| Jan-23 | 2.30% | 3.44% | 3.96% | 5.46% | 4.55% |

| Feb-23 | 2.70% | 3.30% | 3.82% | 5.09% | 4.84% |

| Mar-23 | 2.33% | 3.70% | 3.72% | 5.15% | 4.72% |

| Apr-23 | 2.31% | 3.77% | 3.35% | 5.07% | 4.61% |

| May-23 | 2.36% | 3.44% | 3.47% | 5.20% | 4.63% |

| Jun-23 | 2.64% | 3.43% | 3.46% | 5.15% | 4.50% |

| Jan-24 | 2.07% | 2.70% | 3.58% | 5.00% | 4.10% |

| Since Oct 2022 | 0.06% | -1.61% | -1.30% | -2.13% | -1.14% |

| Since Jun 2023 | -0.57% | -0.73% | 0.12% | -0.15% | -0.40% |

As you can see, since October 2022, our top recommendation to buy 5-year EUR-denominated Romanian bonds has done quite well.

Our recommendations to buy Bulgarian and Hungarian EUR-denominated bonds have also done relatively well. Surprisingly, the Greek government bonds have also performed very well – something we did not expect.

This is partly because the credit agencies upgraded Greece to an investment grade rating. However, given that levels of Greek bonds are very close to those of Germany, we do not expect that outperformance to continue.

Best Idea: Buy 5-year Romanian Government Bonds (EUR-denominated)

We believe the ECB will gradually start lowering interest rates in the Euro Area in 2024. This environment benefits bonds with junk credit ratings (below BBB) or near junk credit ratings.

We view the current 5% a year for 5-year maturity as exceptional value with little risk of substantial downside. We think that those bonds have the potential to produce a 7-10% total return in 2024.

Alternative: Buy 5-year Bulgarian Government Bonds (EUR-denominated)

History suggests that BBB-rated bonds like that of Bulgaria do very well when central banks start lowering rates. While the present level of 3,58% a year is not as attractive as that of Romania, there is quite the caveat – Bulgaria is expected to enter the Euro Area in 2025.

Should that happen, we expect the rating agencies to upgrade Bulgaria’s credit rating.

We see no reason why Bulgaria’s 5-year EUR interest rates should be higher than Greece’s. We think the upside of that position is relatively high – we expect a total return between 5-12% in 2024.

Left out: Greece and Hungary

While we are not bearish on those countries’ bonds, we don’t think the prices justify the risks.

Yes, Greece has improved its creditworthiness, but the Debt/GDP ratio is still relatively high – 170%!

Hungary yields are attractive but not better than those of Romania! And let’s not forget that the government of Victor Orban is in a state of perpetual conflict with the EU, or so it seems on the outside.