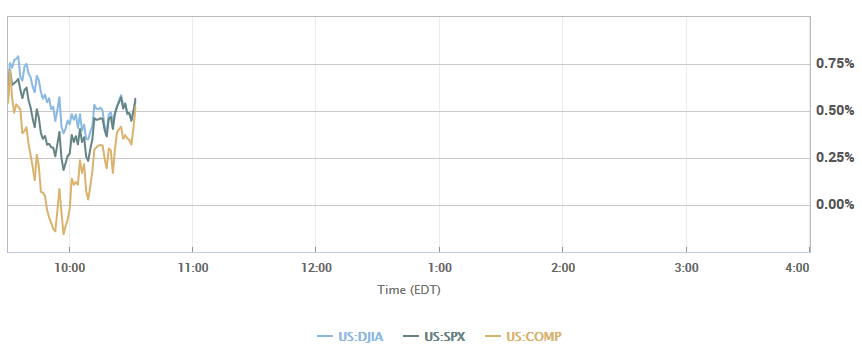

U.S. stocks opened firmly higher on Thursday, with equity benchmarks attempting to snap a two-session skid fueled by worries about technology shares. Despite a rough patch for the tech sector, the main three benchmarks were set to finish the week higher. However, the indexes are on pace for losses for the month and the quarter. The Dow Jones Industrial Average DJIA opened up 190 points, or 0.8%, at 24,037, the S&P 500 index SPX climbed 17 points, or 0.7%, at 2,621. The Nasdaq Composite Index COMP meanwhile, advanced 38 points, or 0.5%, at 6,986. Markets will be closed on Friday for Good Friday and ahead of the Easter and Passover holidays. The gauges are on track for sharp losses for March. The Dow is looking at a 4.7% monthly decline, the S&P 500 is poised for a 4% fall, and the Nasdaq is on course to pull back 4.5%, according to FactSet data. For the first quarter, the Dow and the S&P 500 are on track to fall by 3.5% and 2.6%, respectively. That would mark the first losing quarter for those indexes since the third quarter of 2015. But the Nasdaq Composite could eke out a first-quarter rise of 0.7%. Thursday’s moves follows a batch of stronger-than-expected data. Initial jobless claims fell by 12,000 in the latest week, falling to their lowest level since 1973. Separately, consumer spending rose 0.2% in February, while incomes were up 0.4%. In corporate news, Facebook Inc.’s shares [: FB] were on the rise after a week in which the social network lost 13% of its value on the back of a scandal related to its handling of user data.