Are Eastern European Bonds Way Too Undervalued

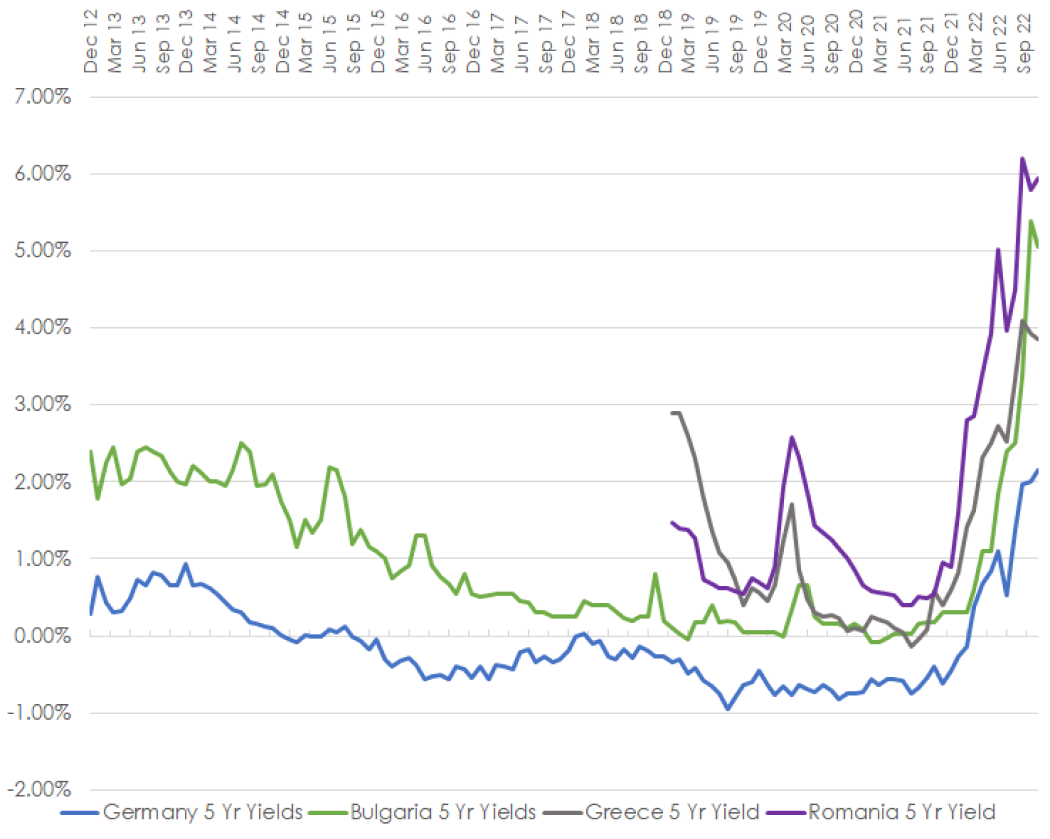

Bulgarian and Romanian Government Bonds are now cheaper than those of Greece

- At the end of September, the Bulgarian Ministry of Finance issued bonds with a maturity of 5.5 years, and the interest rate was around 4.13%. The yield is about 1.5% higher or 5.6% two months later.

- The EUR bonds of Romania are now trading at a level similar to that of B/BB-rated countries like Turkey or Albania.

As we mentioned in the previous issue of Market Insights, the environment has changed, and we expect fixed income to recover in the next several quarters from its extremely oversold levels. While all government bonds were relentlessly sold in 2022, there are quite a few bargains in EUR-denominated sovereign bonds.

Best Buy: Romania (BBB Rated)

Before 2022 Romanian 5-Year Government Bonds denominated in EUR traded on average between 150-200 bps higher than German 5-Year Government Bonds.

Currently, that spread is nearly 400 bps. This spread is unjustifiably high and driven mainly by illiquidity and panic selling of not well-capitalized Romanian banks. The local investor is panicking because the Central Bank of Romania has raised the interest rate in RON from 1,75% to 6,75% (or nearly double the increase of ECB) over the past year. The performance of RON-denominated bonds has mirrored that of EUR.

The EUR bonds are now trading at a level similar to that of B/BB-rated countries like Turkey or Albania.

While it is difficult to say if there will be or will not be any problems with Romanian financial institutions, Romania can handle this problem. The country has a Debt/GDP of 49%, and while this has increased from 35% since 2019, it is still below the average EU Area Governments and WAY, WAY below Greece and Italy’s Debt/GDP ratios. And Romanian Bonds are now trading cheaper than those countries – 200 bps cheaper than Greece and 250 bps cheaper than Italy.

The alternative Choice: Bulgaria (BBB Rated)

Before 2022 Bulgarian 5-Year Government Bonds denominated in EUR traded on average between 100-125 bps higher than German 5-Year Government Bonds. Currently, that spread is nearly 300 bps. This spread is unjustifiably high and primarily driven by illiquidity and general aversion from investors to counties not in the EUR Area. While Bulgaria is not technically in the EUR Area, its currency, the BGN, is actually pegged to the EUR. Its bonds are trading 125bps cheaper than similar Greek bonds and 200 more affordable than Italy’s. Its Debt/GDP ratio is 22%, little changed from 2019. Yes, Bulgaria is governed by a caretaker government, but that is not necessarily of grave concern to bondholders.

Key Takeaway

There are patterns of cyclicality in Emerging market bonds. When the Fed begins a tightening cycle (raising rates), emerging bonds take it on the chin, and they cheapen a lot more than similarly rated US corporate bonds. On the other hand, when the Fed pauses or starts lowering rates – they tend to appreciate and outperform similarly rated US bonds.

Those cycles of outperformance and underperformance tend to be relatively long and usually remain hidden from the mass investor as many bonds mature, or their duration decreases dramatically during the prevailing cycle. The only way to observe the phenomenon is by keeping statistics about the USD-denominated emerging market debt yield curve. Which most investors rarely do.

Get the trading edge you need in today’s markets – sign up for our monthly newsletter featuring in-depth expert analysis, hot market insights, and exclusive trading strategies.

Sources:

Bulgarian National Bank https://www.bnb.bg/

Investing.com https://www.investing.com/

Disclaimer: