An Investor Shopping List: 20 High-Conviction Stocks with Average Upside of 25%

Like POTUS’s chances for a Nobel Peace Prize, investor enthusiasm for stocks may not be such a sure thing at the moment.

News that North Korea may bail on that historic summit could adding to the market’s recent worries. That’s after a jumping 10-year yield and dollar strength helped put a halt to the Dow’s eight-session advance yesterday.

it’s almost like the North Koreans wanted to suck Trump into a summit that was good PR for them but never really intended to give up anything. Unfortunately, no one saw this coming and there was no way to guess that this could happen.

If this market has truly turned a corner, investors may want a little more proof. Still, a bump in the road may not deter those who love the thrill of the hunt for good stocks.

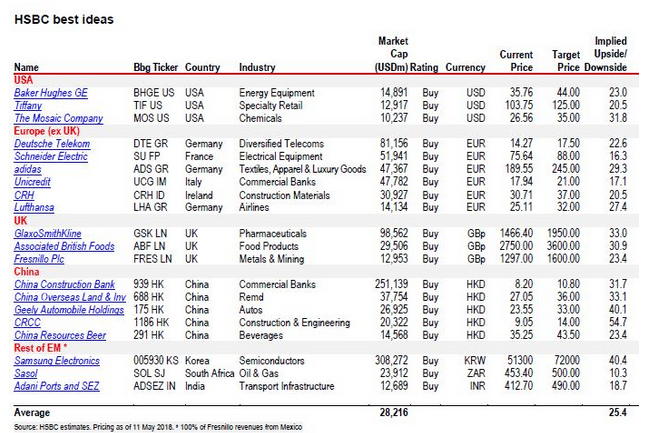

That brings us to our call of the day from HSBC global equity strategist Ben Laider and his team. They offer up 20 stock picks from around the world, saying they have the potential to gain 25% on average from here.

Investors are looking at “more normalized and lower equity-market returns” so stock picking is even more important, Laider says. And rising volatility opens up “great opportunities for potential market dislocations and mispricing,” he writes in a note to clients.

First pick, Mosaic MOS, +0.44% , which HSBC rates a buy with a $35 price target — making for 32% upside. Why buy? Short supplies seen for phosphate — vital to plant growth — as well as strong earnings and an attractive valuation.

Next, Baker Hughes BHGE, +0.39% , buy rated and with the potential to climb 23%. It’s on track to score $700 million in synergies this year, as well as achieve $7.8 billion in free cash flow over the next three years, says HSBC.

And a little blue box of luxury: Tiffany TIF, +1.98% , which HSBC likes thanks to its thriving jewelry segment, a management shake-up and a return to growth. They’ve got a $125 price target, implying 21% upside.

Take a look at the following chart, which lays out the rest of Laider & Co.’s picks across Europe and emerging markets:

Key market gauges

It’s a mildly positive start for the Dow DJIA, S&P 500 SPX, and Nasdaq COMP.

The 10-year Treasury yield TMUBMUSD10Y is hovering near a 2011 high.

Asian stocks struggled amid jitters over North Korea. New Zealand stocks NZ50GR slumped 1.8%. Europe stocks are mostly lower, with Italian stocks I945, down over 2% on worries about radical plans by antiestablishment parties to change the country’s relationship with the EU.

The dollar DXY, is up again, oil CLM8, is soft, and gold GCM8, is holding steady.

The buzz

Macy’s M, posted some blow-out results today. Cisco CSCO, and Take-Two TTWO, are due after the close. Walmart WMT, posts results Thursday.

Amazon AMZN, is rolling out Whole Foods discounts for Prime members in Florida, with those price cuts going nationwide this summer.

First-quarterly filings for big investment funds may put some stocks in play: Warren Buffett’s Berkshire Hathaway BRK.A, BRK.B, added to Teva TEVA, and Monsanto MON. Dan Loeb’s Third Point took stakes in Wynn Resorts WYNN, United Tech UTX, and upped a Facebook FB, holding. Soros Fund Management upped its Aetna AET and Baxter BAX stakes.

David Einhorn’s Greenlight Capital added to its Brighthouse Financial BHF stake and trimmed Apple AAPL and GE GE holdings. Stanley Druckenmiller put his money on chip stocks like Intel INTC, Micron MU and Qualcomm QCOM.

Twitter is planning to crack down on trolls with software that automatically demotes their tweets.

Ireland-based bookie Paddy Power PPB is in merger talks with FanDuel over a U.S. business. That’s as the U.S. Supreme Court opens the door to widespread sports betting. Fun fact: Americans lost $107 billion last year on state-sanctioned gambling.

Milk lovers were crying in New Zealand. That index slumped about 1.8% after A2 Milk ATM got crushed 13% over disappointing results.

On the economic beat, housing starts, industrial production and capacity utilization rolled out this morning. Atlanta Fed President Raphael Bostic and St. Louis Fed President James Bullard are both speaking today.

The chart

It was notable yesterday that some safety plays like gold or the yen didn’t get much of a look-in even as stocks were slumping. Another such play, the Swiss franc USDCHF, hasn’t had a great time of it either.

True Contrarian scribe Steven Jon Kaplan says investors should consider taking a bullish position on the Swiss currency. He tells his subscribers that the franc has had some bouts of dropping below parity against the dollar, which goes against history and “isn’t justified.”

Article and media were originally published by Barbara Kollmeyer at marketwatch.com