Understanding the Time Lag in FED Inflation Policy

Imagine the Federal Reserve (FED) as the conductor of a financial orchestra, trying to keep inflation in harmony. One important note in their song is the “time lag.” In this article, we look at why this time lag matters in the FED inflation policy, building upon what we discussed in our earlier article, “Inflation 2023 and Beyond: Projections and Insights.”

To make sense of the time lag, let’s rewind a bit. Before the 1970s, money worked differently. Most countries tied their money to gold, and significant changes in inflation, like prices going up a lot or deflation, prices going down, were usually because of important events like wars or natural disasters.

Even though 50 years might seem like a long time, it’s not long in terms of how things work in money. This article will explain you how the FED handles inflation and why this time lag is crucial in their decision-making.

Monetary Policy and Inflation Control

The “Gold Standard” in terms of theoretical understanding of Modern Monetary Policy remains the work of one of the earliest researchers in the field and Noble Prize Winner – Prof. Milton Friedman. We have written multiple times about his model and what it implies for the present. That inflation can only continue to recur if and only if we continue to print new money.

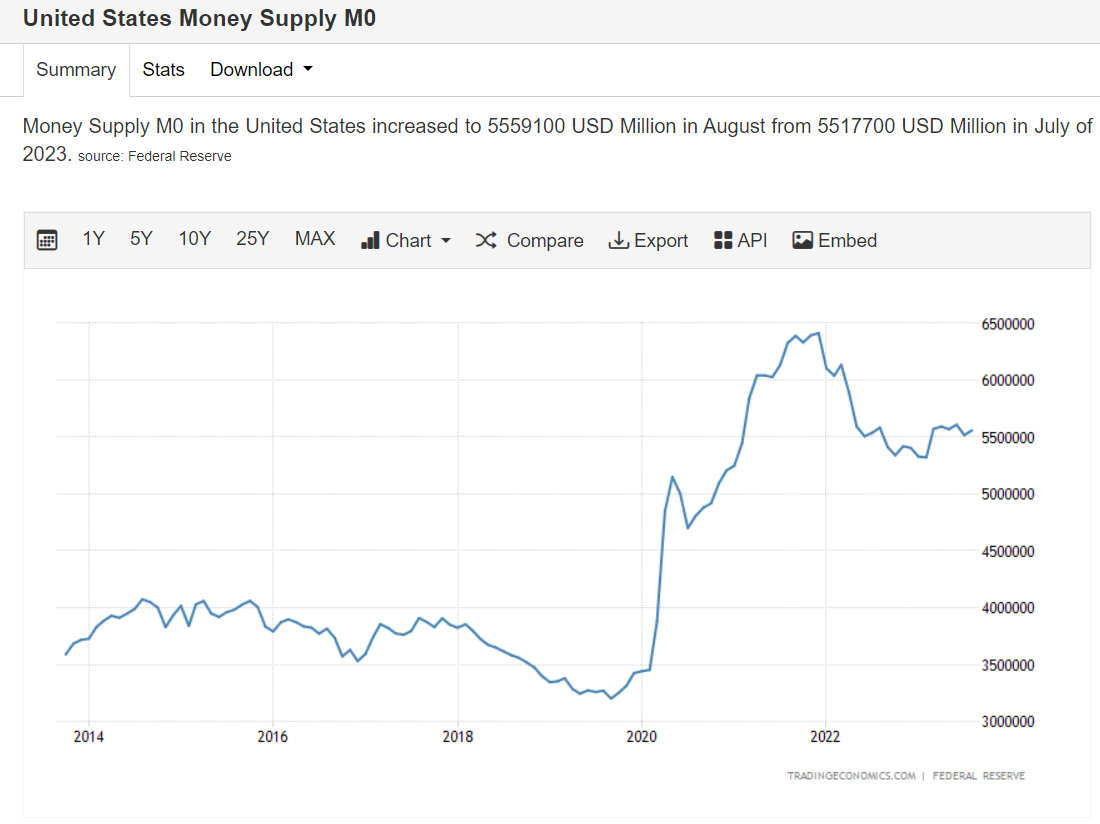

Most Central Banks and the Fed, in particular, stopped printing money in early 2022 (please see M0 Money Supply for the US below):

In the media nowadays, we often hear one of the many arguments that inflation is “surprisingly” stubborn and might persist for the long run. “Stubborn inflation” is a phenomenon Prof. Friedman explored in his work. He referred to it as the “long and variable lag between monetary policy changes and their impact on the economy.”

In plain English, the economy takes a long time to fully absorb interest rate changes. We expect stubbornly high inflation even if we raise interest rates above current inflation levels. The opposite – inflation quickly subsides after interest rate hikes is possible but tends to occur rarely (if ever). A much more common scenario is for inflation to decrease after a considerable period.

How long is that considerable period? Prof. Friedman indicated that in most cases, that significant period is about sixteen (16) months.

FED Inflation Policy and Battle Against

The Federal Reserve raised rates from 0,25% to 4,25% in 2022 and from 4,25% to 5,25% in 2023. The most aggressive rate hikes occurred between June 2022 and December 2022, when rates were raised from 1,50% to 4,25%.

It has been roughly speaking only 12 months since those aggressive rate hikes – it is quite possible the US economy does not fully absorb their effects. We do not mean that they have had no impact – only that empirically speaking, full results take a long time to materialize.

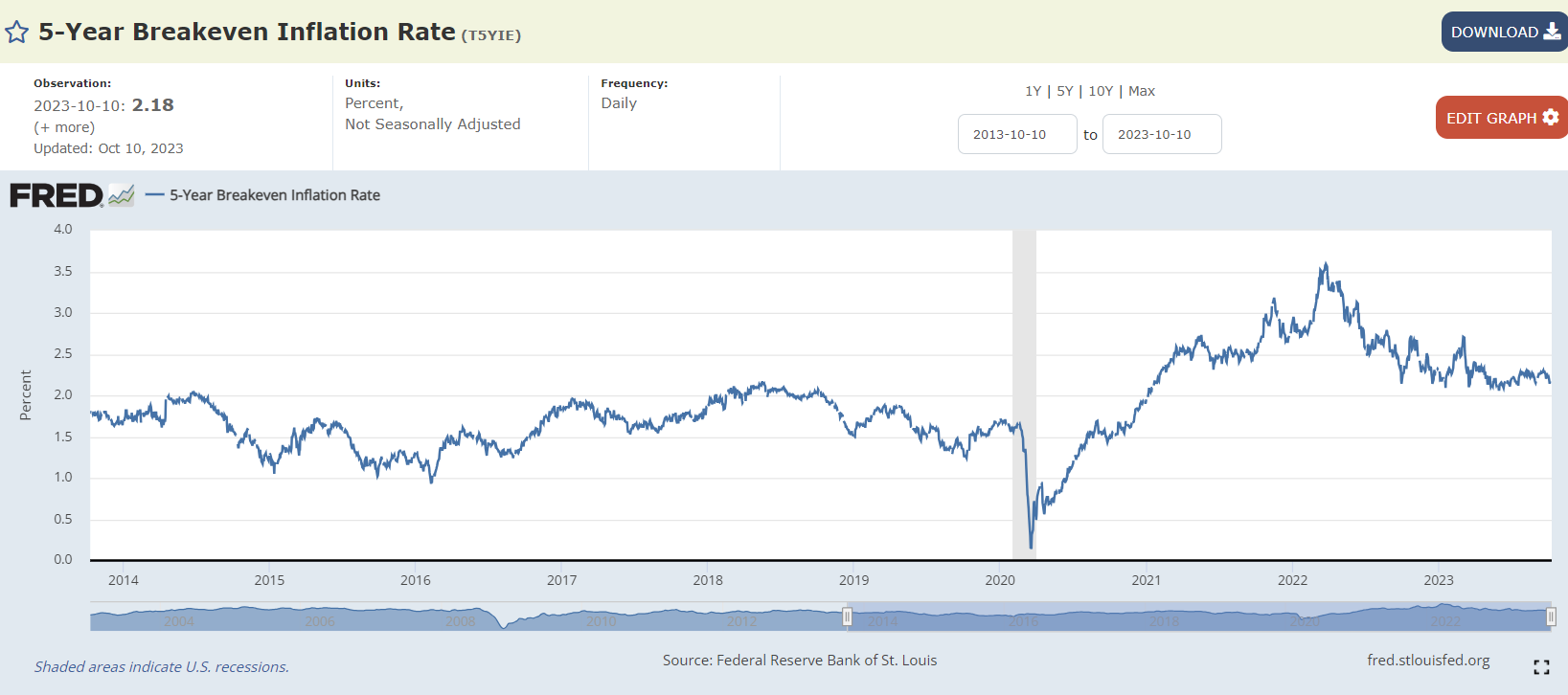

We already see that the markets for future expected inflation have already normalized – please see the 5-year breakeven inflation rates below:

The markets expect inflation in the next five years to average 2,18%. The Fed may have already achieved its goal of controlling inflation; it will just take a few more months to see evidence that this is the case.