Money Management: Quick Look at Leveraged Shares Performance

Why Trading Leveraged Shares is Like Driving on a Flat Tire

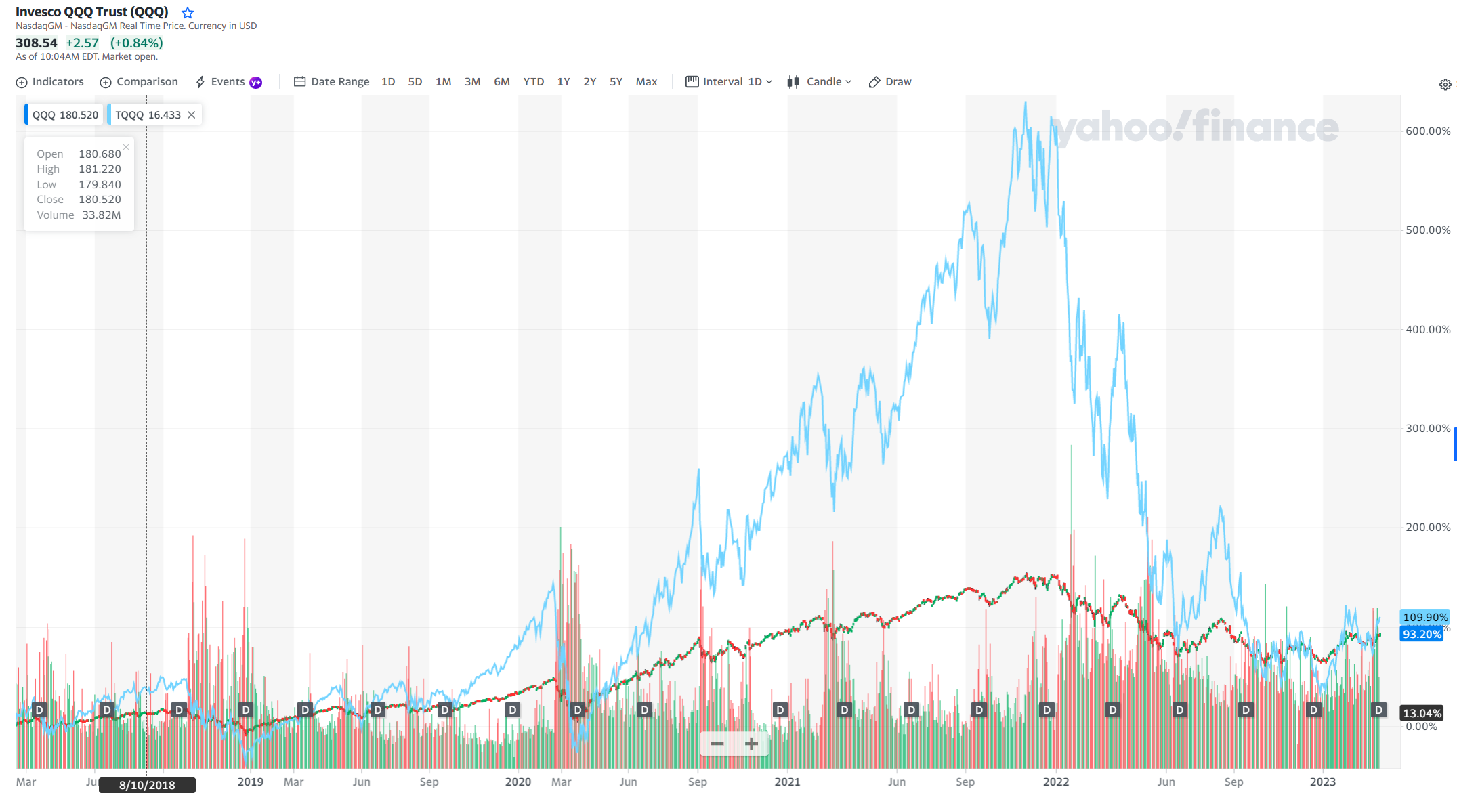

Leveraged shares trading is getting very popular nowadays. Multiple 200% and 300% leveraged shares ETFs aim to replicate 200% or 300% of the DAILY return of their benchmark. Let’s start with one of the most popular ones — TQQQ ETF, which aims to replicate 300% of the daily return of QQQ ETF.

From April 2018 till now, March 2023, a span of 5 years, the benchmark QQQ is up 93.20%, while the leveraged ETF that tries to make 300% of that return is up 109.90%! We don’t know how else to describe this performance, except for massive underperformance. If you leverage 93,20%, the return of the benchmark QQQ, by 300%, you should expect to get 279,60%. That is about 300% underperformance – the return over the last five years of QQQ and TQQQ is nearly the same, while the volatility of TQQQ has been three times higher than that of QQQ

The proponents of leveraged shares are fast to admit this flaw; they say, over the long run, leveraged shares can have very different performance from that of their benchmark. The stated goal is to produce 300% only versus the DAILY returns. It is unfair to compare their performance over multi year periods. Fair enough, let’s shorten the holding horizon to six months:

So, for the last six months QQQ is up 12.43% while TQQQ is up 20,77%. The underperformance of about 15% in six months, while not exactly unbearable, is undoubtedly NOT insignificant. It is hardly the disaster we saw in five-year performances, but it is hard to call it a success.

In conclusion, while leveraged shares DO follow their stated investment returns daily, the difference in long-term performance is quite striking. Holding leveraged shares for any period longer than a few days leads to underperformance. If that holding horizon is longer than a year, the underperformance is nothing short of a disaster!

As a result, we avoid trading those products and do NOT recommend them to our clients.

Disclaimer: