US Job Openings Point to Strong Market Recovery in 2023

In contrast with the shallow consumer confidence and hawkish FED policy, the labor market dynamics stays bullish

During the last several months, we started hearing about companies downsizing — Meta (META), Goldman Sachs (GS), Google (GOOG), and Microsoft (MSFT), to name a few. These companies are some of the biggest employers in the US, and some of them, like GOOG, have never laid off people. So, is it bad ‘out there’? And if it is, how bad is it exactly?

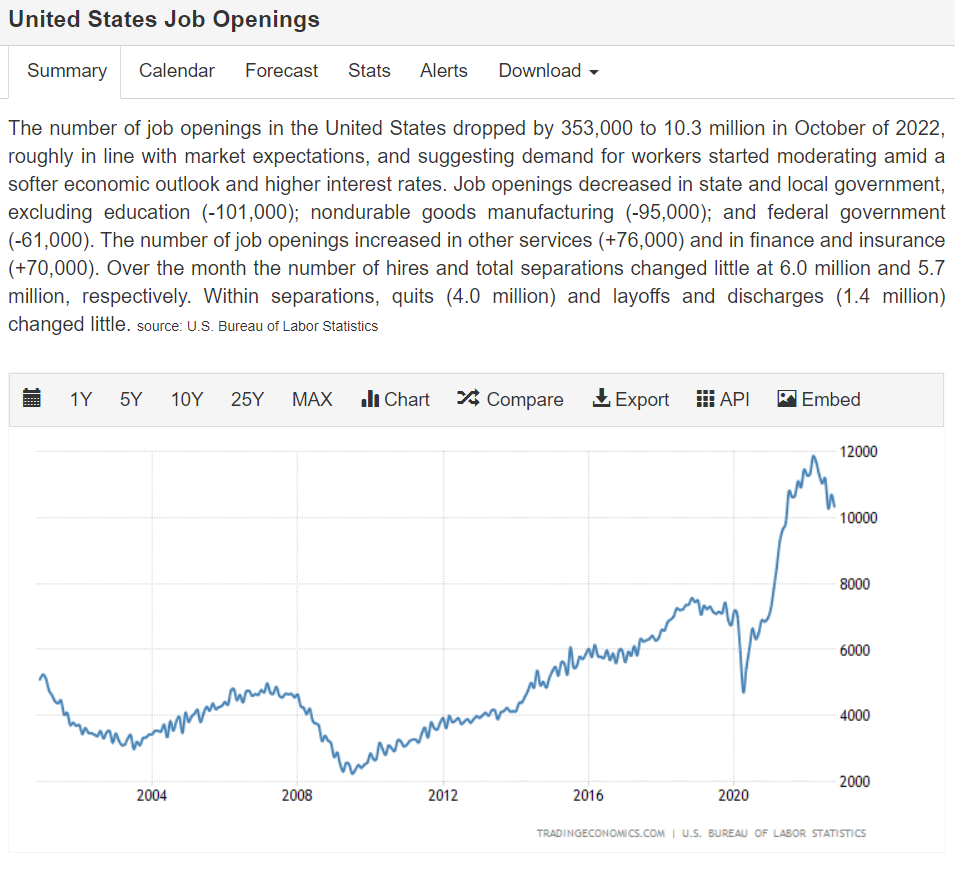

Let’s look at US Job Openings:

It is important to note that there are differences between jobs — the downsized positions at GOOG, MSFT, and META were probably very well paid. Nevertheless, the US labor markets appear to be exceptionally STRONG! While job openings in 2022 DID decrease, they went from record 12MM job openings to a low of 10MM and currently stand at 11MM; that is hardly a disaster, considering that at the beginning of 2020, they stood at a level BELOW 8MM.

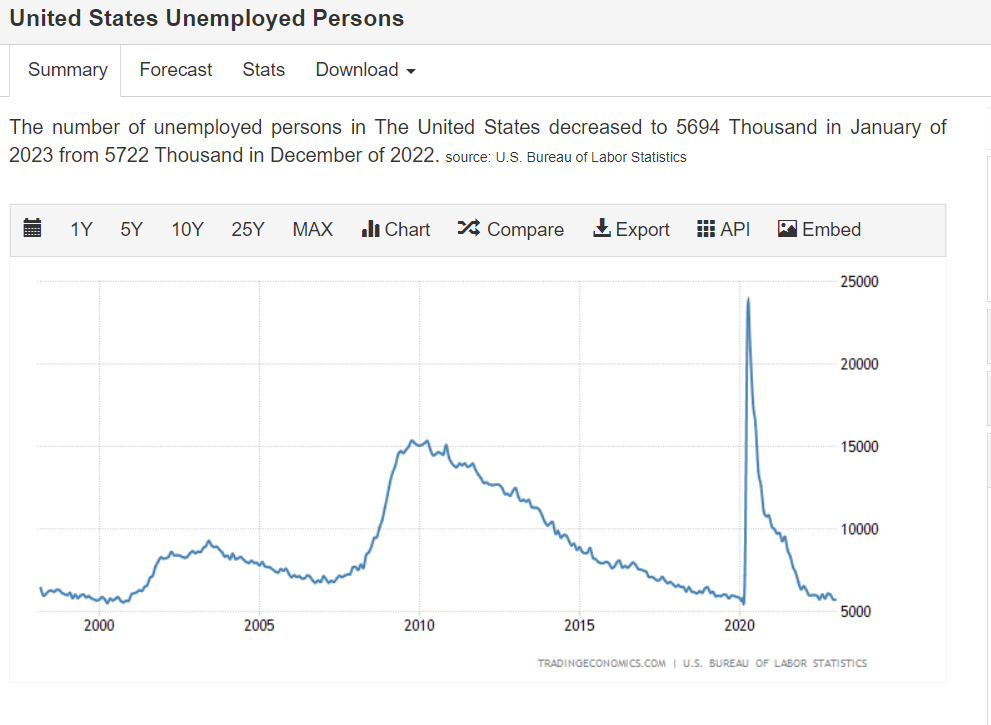

This is even more impressive considering the number of unemployed people in the US:

As of January 2023, there were roughly 5.7MM people unemployed in the US. Let’s repeat that one — there were 11MM job openings and 5.7MM unemployed people. That makes approximately 1.9 available jobs for everyone looking for one!

Even more amazing about the strong labor markets is that these bullish dynamics are contrasted with shallow consumer confidence, hawkish FED, and unprecedented geopolitical tensions!

Given that employment is by far the BEST predictor for future economic performance and stock market performance, we expect a strong market recovery in 2023.

Sources:

Disclaimer: