10 Year Treasury Bond Yield Near 5%: A Rare Bargain

Exploring Market Trends and Why High Yields Offer Unique Opportunities

US Treasury Bond yields have experienced a turbulent ride over the past several months, highlighting notable shifts in market dynamics. The 10 Year Treasury Bond Yield, which hit a low of nearly 3.6% in mid-September 2024, has surged to 4.75% in less than four months. This significant rise sparks concerns about inflation risks, market trends, and broader economic stability.

Below is the 10-year US rate chart, sourced from Yahoo Finance:

This is particularly surprising as the Federal Reserve has already lowered interest rates to 4.5% and indicated that, pending additional data, markets can expect one or two more rate cuts in 2024.

Is it possible that 10-year rates go above 5%? Can this be an indication that a new wave of inflation is coming?

Implied Volatility: Are Markets Panicking

Well, while many things are possible, the possibility of them occurring is not necessarily high. Let’s take a look at the implied volatility of TLT, VXTLT, which is the ETF for 20+ year Treasury Notes ETF:

In those stressful times, it is essential to keep in mind what is real and what is just potential. What is real is that inflation can only come to a country if the central bank of that country expands its balance sheet.

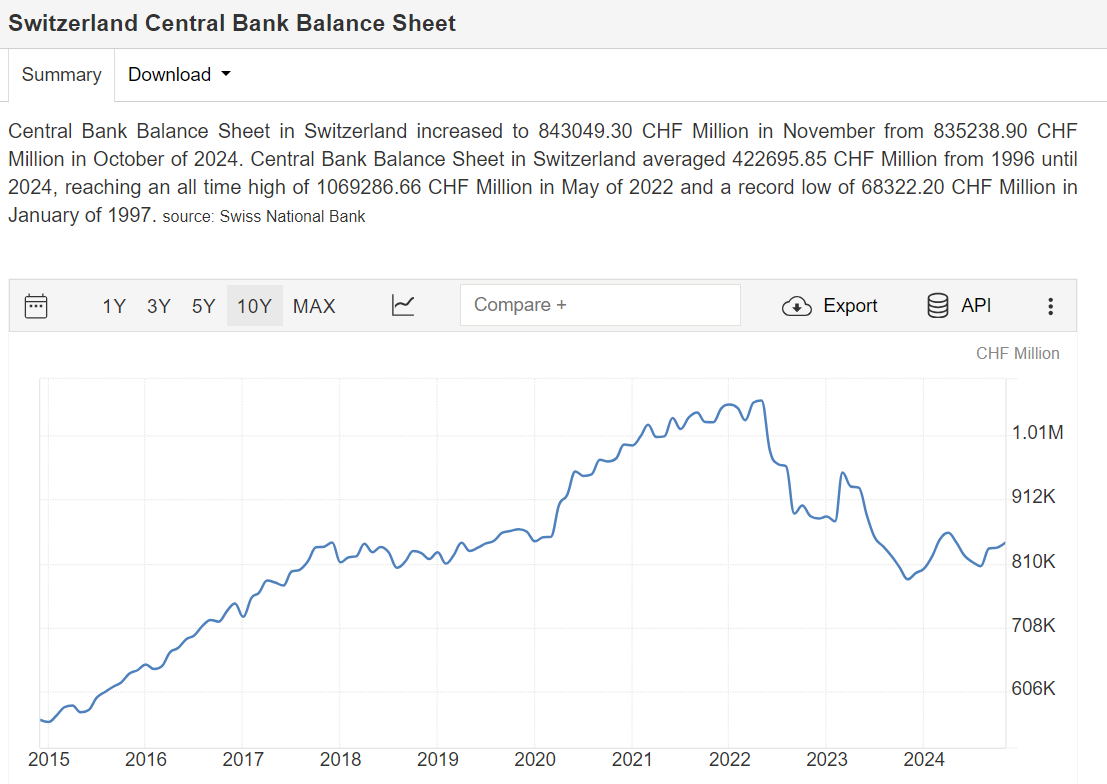

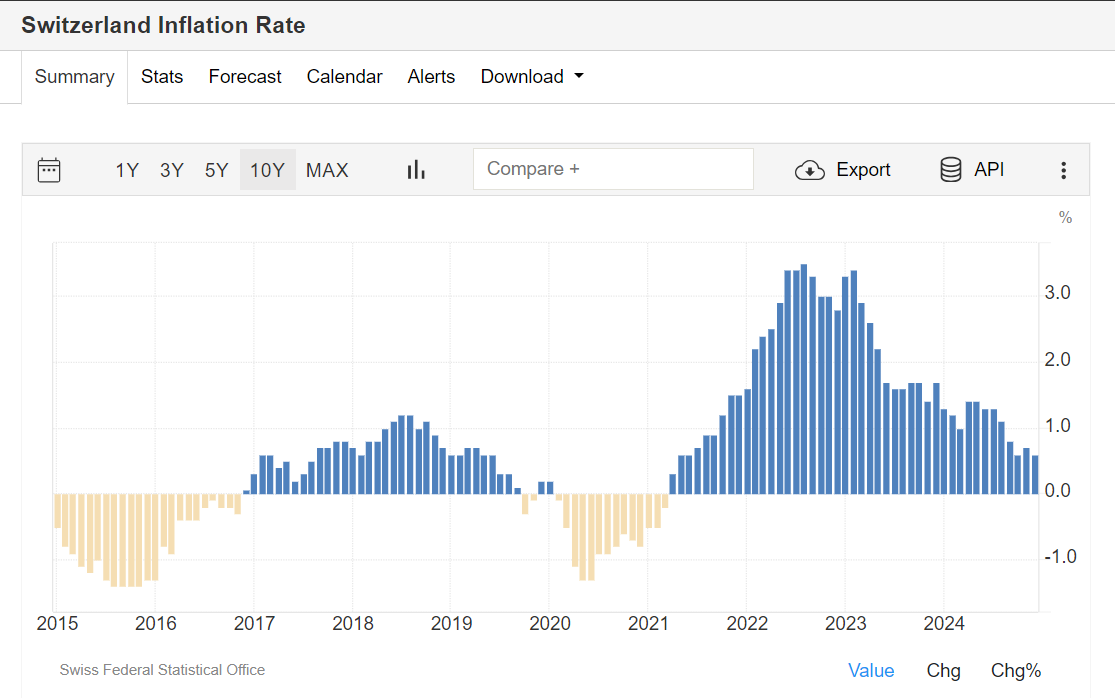

A Look at the Swiss National Bank’s Example

The Swiss National Bank (SNB) provides the best example:

The SNB reduced its balance sheet to level comparable to those of 2019 and inflation disappeared:

Yes, the annual inflation rate in Switzerland for 2024 was 0.60%. Yes, central banks can contain inflation—this is not something that comes out of nowhere like a flu virus.

In order for inflation to persist, the central bank needs to expand its balance sheet.

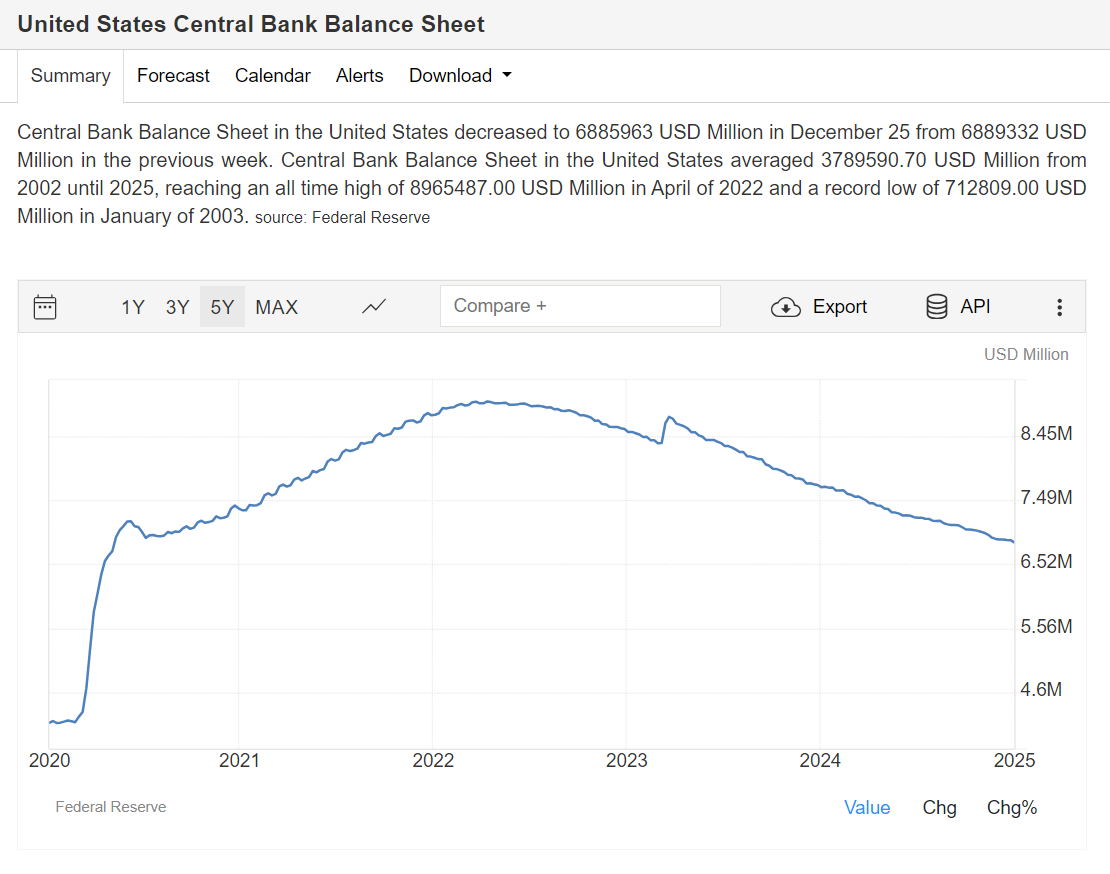

The Federal Reserve Balance Sheet: A Key to US Inflation

How is the Fed Balance sheet? Let’s take a look:

The size of the Fed Balance Sheet is steadily decreasing, and if we are to trust Chairman Powell, it will not start increasing until inflation is under control in the US, safely below the 2% threshold.

Tariffs and Inflation: A Gradual Risk

Yes, if President-elect Donald Trump introduces tariffs, it is possible that we might see inflationary pressure, but the timing, size, and impact of those tariffs are largely unknown at this point. Moreover, introducing those tariffs is not necessarily guaranteed to show inflationary pressure immediately.

Therefore, their impact could have a much more gradual effect. And even if there is inflationary pressure, it will be mostly a one-off effect. Sustainable inflation in the US will occur only if the Fed starts increasing its balance sheet.